Photographs: Reuters Kumar Gautam, Outlook Money

Retail investors, hoping to make money quickly, typically find it difficult to resist the temptation to buy shares when the stockmarket is rising.

That temptation, anecdotal evidence suggests, is even stronger now than before as many of them missed the rally over the last year waiting for a correction to enter the market.

However, the fundamental problem with investors in such a market is that they tend to pay too high a price for the estimated growth of the companies they invest in, assuming, of course, that the companies can deliver according to expectation.

Therefore, in conditions like these, safety of investment assumes greater importance than commonly perceived.

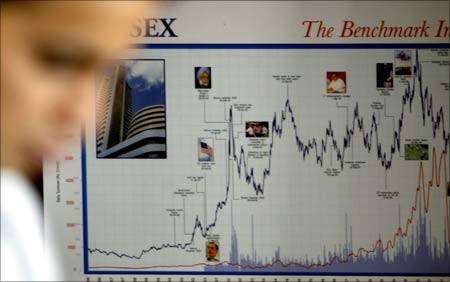

It has been written at length, both in this magazine and elsewhere, that the current rally in the equity market is, to a very large extent, being driven by liquidity in the global markets.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

The more money central banks around the world print to boost their own economies, the greater is the inflow into markets like India. With the market at its current level, most stocks have seen substantial appreciation and their prices are either on the edge of reason or beyond.

One option for the retail investor trying to enter this market, therefore, is to wait for a correction to enter the market, in other words, try to time it.

To get it right, however, the retail investor would need a liberal helping of luck, even though one school of thought strongly believes that the stockmarket is likely to see deep cuts.

The other option is to look for value and find stocks with upside left even in this market. But one needs to be careful about fundamentals and track record. The second exercise is what we have undertaken, and here are five good medium- to long-term buys.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

1. Jyoti Structures

Strong businesses are built, normally, when challenges are converted into opportunities. It is an accepted fact that infrastructure is the biggest impediment to achieving the desired double-digit growth in India, and power shortage has long been responsible for a low level of manufacturing activity.

Thankfully, the government is taking the matter seriously now. Activity in the sector has also gone up significantly with private sector entering the business.

To put this in perspective, India will require additional power supply of 100,000 MW by 2017 and, according to plans, an estimated Rs 2,40,000 crore (Rs 2,400 billion) will be spent on the sector during the Twelfth Five-year Plan period.

It makes perfect sense for the investors to be part of this huge opportunity to enhance long-term gains.

Outlook Money in the past has recommended two companies in power sector financing business -- Power Finance Corporation and Rural Electrification Corporation. This time we highlight Jyoti Structures, a mid-sized company, in the business related to the power transmission sector.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

The company works in areas of transmission lines, sub-stations and setting up distribution networks, with the capability to execute turnkey projects in all areas of power distribution.

It has proved its credentials by clocking a five-year compounded annual growth rate (CAGR) of 35 and 50 per cent, in topline and bottomline, respectively. Also, the fact that it sitting on an order book of over Rs 4,000 crore (Rs 40 billion), roughly twice its fiscal year (FY10) revenue, should give confidence to investors about its future.

From the order book of Rs 4,106 crore (Rs 41.06 billion), 82 per cent is from domestic companies. On the domestic side, Power Grid Corporation of India, a public sector distribution company, contributes about 35 per cent of the orders.

In terms of verticals, 68 per cent would be transmission, 21 per cent distribution, while the rest will come from sub-stations. The company remains upbeat on the further flow of orders.

In the quarter ended June 2010, the company's revenues were up 16.30 per cent, while the net profits increased by 17.69 per cent.

In the market, the stock is currently trading at 12 times earnings, and with a strong order book, proven track record and earning visibility, it makes a strong case for a buy.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

2. Shree Cement

The problems affecting the cement industry are well-established. Despite a strong correlation between demand for cement and economic growth, the industry has struggled to achieve high bottomline growth.

An overcapacity, which brings down the cement price and thus the margin, is certainly the biggest problem. The volatile price of power and fuel, which are the major costs for cement companies, further makes it difficult to maintain margins.

However, Shree Cement, north India's largest cement producer, has delivered strong growth both during the upturn and the downturn of the cement cycle despite all these risks.

Overall, the industry's capacity utilisation went up from fiscal year 2003 (FY03) to FY08. Shree Cement also benefitted from it and reported around 34 per cent and 107 per cent growth in total income and profit, respectively.

In the following years, FY 09 and FY10, the realisation for the industry declined. Nevertheless, Shree Cement's growth figures were still attractive during this period. The topline and bottomline rose annually by 27 per cent and 61 per cent, respectively.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

All these years, the company rapidly ramped up its production facility to boost its topline, but also took care that the margins continue to improve, which is now the highest compared to its peers, to grow the profit.

Several factors have allowed it to do so. First, the gestation period of capacity addition is low, which help it react quickly to demand surge and avoid idle capacity.

The company also has the advantage of proximity of its plants to the market, which reduces freight cost. Also, as Shree Cement's market is mainly north India, which has traditionally been a high-value market, the realisation for the company is high compared to players in other regions.

The most critical factor for Shree Cement is its venture into the power business. Building captive power units, which now meet the entire power needs of the company, has not just helped reduce costs, but will also help it in times of downturn in the industry.

Shree Cement now sells excess power on merchant basis (market-determined price), and in FY10 this contributed around 14 per cent of the company's revenues.

It is working towards commissioning more capacity, and when the power business becomes a significant part of the overall business, it will cushion Shree Cement's earnings in the cement downturns.

This suggests that even as the company can bank on construction activities in the economy, in the down cycle, because of a utility business such as power, it will be impacted less.

With the growth drivers in place, a price-to-earnings ratio of 14 is not too much to pay for its shares.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

3. Allied Digital Services

Managing currency volatility has now become the norm for information technology (IT) companies.

Most of their revenues come from exports and if the rupee appreciates against any of the major currencies, such as dollar or euro, their revenue in rupee terms is hit hard.

However, if a company has delivered high volumes, its growth in rupee-terms remains attractive even after shedding few basis point growth on account of currency movement. And that is the case of IT services provider Allied Digital Services (ADS).

Its growth is impacted by currency movements, but high volume growth has ensured attractive top- and bottom-line growth in rupees.

ADS has over two decades of experience in providing IT services to its clients across several domains and geographies.

IT services is categorised under verticals such as infrastructure management services, remote management services, networking and communication solutions, and enterprise consulting solutions, among others.

In Q1FY11, around 70 per cent of revenue was generated domestically whereas 30 per cent came from exports to geographies such as the US and Australia.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

The services provided by ADS are similar to other IT companies, but it has managed to deliver superior growth rates.

Between FY07 and FY10, the total income has increased over fourfold from Rs 156 crore (Rs 1.56 billion) to Rs 697 crore (Rs 6.97 billion), or a CAGR of 64.71 per cent.

The bottomline increased at a similar pace. In FY09, when volume growth of the overall IT industry was low, ADS managed a topline growth of 26 per cent. A higher growth in profit of 38 per cent indicate that unlike other IT companies, it was not impacted much by pricing pressure in the downturn.

One reason that allowed it to grow was that it took the inorganic route to growth, which was reflected in high growth figures on the consolidated income statement.

But even if performance of the subsidiaries is ignored, in FY10 the company reported 32.30 per cent and 78 per cent growth in total income and profit, respectively. Company's focus on domestic market, which is 70 per cent of the revenue, was the major reason for it to sail safely through recession in the developed nations.

In the coming quarters, the company is expected to report high growth. In post Q1FY11 analysts' conference call, the management has said the order book is to the tune of Rs 565 crore (Rs 5.65 billion), which is over two quarters of total revenue.

The margin, which improved in the past few quarters, is expected to improve further, as the company focuses more on high-margin value added services to its customers.

At the end of Q1FY11, the company had a cash balance of Rs 180 crore (Rs 1.80 billion), and that helped it in taking inorganic routes to growth.

With its annualised earnings-per-share for FY 11 is estimated at Rs 28 and price of its share of Rs 224.40, the stock certainly looks undervalued at a price-earnings multiple of eight.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

4. EClerx Services

One parameter that went into selecting stock recommendations for this issue was to judge a company's performance even in bad economic conditions, and eClerx Services -- a knowledge process outsourcing (KPO) services provider -- stood out on it.

The KPO industry was in the doldrums in 2009. Though there is no industry-specific data to support this as most of the players are not listed, anecdotal evidence such as freezes in hiring and salary cuts suggest so.

However, it was an interesting time for eClerx. It hired more that year (almost 30 per cent rise in headcount) and the revenue went up by 62 per cent. It does indicate eClerx's differential nature of business in a cluttered IT industry.

eClerx's analytics, process and data management services is divided into two verticals -- financial services and sales and marketing support.

Services under financial services head include back office services, finance and accounting and risk management.

Sales and markets support bundles services such as competitive pricing and catalogue analytics and data management.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

The company boasts of servicing 13 of the Fortune 500 companies. What has really differentiated its services from that of other KPO companies is that they support the core activities of the clients that are non-discretionary in nature. So, during the financial crisis of FY09 and FY10, even as many of eClerx's clients in the banking industry went under, were desperately restructuring, or were acquired by stronger ones, eClerx didn't lose its business.

The company also used the opportunity during the downturn to attract the best talents in the industry. Another factor that differentiates the company is the nature of contracts it undertakes.

Most of the companies in the KPO industry get revenue from projects that are short-term in nature and comes at inconsistent intervals. However, eClerx undertakes projects that are 2-3 years long, and are on an annuity basis.

It also avoids "request for proposal" route to win projects. In fact, most of them are repeat projects from the existing clients. These factors add an element of stability and predictability to its revenue.

eClerx just has a decade's experience, and it got listed on the exchange as recently as 2007. It has shown a phenomenal growth in the past few years.

From 2006 onwards, the revenue rose at a CAGR of 51 per cent from Rs 47.8 crore (Rs 478 million) to Rs 246.5 crore (Rs 2.465 billion) in FY10.

During this period the profit grew at 32 per cent. The balance sheet is liquid with no debt and high amount of cash.

The profitability ratio, such as return on equity, is also high at 40 per cent. You can rest assured that the company's stock has gained attention from investors, and has moved up 63 per cent in the past 12 months.

However, if we ignore the charts, at an annualised EPS of around Rs 40 and price of Rs 597, a PE level of 15 is still attractive enough for you to buy the stock.

. . .

5 COOL stocks in a hot market!

5. Supreme Industries

With rising activity in the economy, there are a few industries that do not attract sufficient investor attention. The reason probably is that their growth is derived.

Plastic is one such example. From industrial production, construction to consumer durables, plastics play a vital role. Plastics consumption was up 16 per cent in India in FY10.

PVC consumption was 1.8 million tonnes, and with total installed capacity around 1.2 million tonnes, demand clearly outpaced supply. Further, with rising economic activity, the gap could widen. Supreme Industries, the well-established brand in plastics, with a proven track record, is well poised to reap the benefits.

The company, established in 1942, has registered revenue and net profit growth of 12 and 35 per cent CAGR, respectively, in the last five years. In the quarter ended September 2010, sales were up 37 per cent, while the net profits registered a jump of 103 per cent.

Supreme, with 19 production sites, derives revenue mainly from four verticals -- plastic piping systems, consumer products, industrial products and packaging products -- with piping contributing the highest at 43 per cent.

. . .

5 COOL stocks in a hot market!

Photographs: Reuters

Going forward, the company is investing in capacity creation and intends to move up the value chain. In the current fiscal, the company plans to invest Rs 180 crore for this.

It expects the replacement market to gain prominence in the coming years as more and more buildings go for renovation. To the capture the opportunity, it is focusing on its pan-Indian retail network.

Also, to grab the rural market, the company plans to introduce budget-level plumbing solutions which are fit for single storied building.

One concern while investing on this counter could be the sharp run-up in stock prices, which has more than doubled over the last one year.

Barring that worry, this stock is still available at about 12 times earnings. The company also has a strong track record of paying dividends, an indication of a stable financial position. All of which makes it an ideal buying option for the medium and long terms.

. . .

5 COOL stocks in a hot market!

The way to go

Our research indicates that these five companies are inherently strong. That, coupled with the fact that they are still available at reasonable valuations means that their prices may not appreciate substantially tomorrow, or in the short term.

To grow the invested capital, the investor will have to take a long-term view on these companies. There is also the possibility that these stocks, too, would correct in the event of a wider market fall.

Therefore, investors should enter these companies with an investment horizon of at least three years. For, in the short term, there is no saying what will happen.

How we did it

Finding undervalued stocks, especially when too much money is chasing too few stocks, is probably more difficult today than ever.

Our search began with first putting a lower limit of Rs 500 crore (Rs 5 billion) market cap for the companies we looked at, as we did not want to end up with small names, too small to trade and track.

We than looked at five-year financial performances for consistency, as in the past five years, companies have been subject to all the conditions of a business cycle.

Simultaneously, we also kept an eye on the valuation of the stock and compared it to the company's performance, to avoid even good companies at bad prices.

After a looking at softer issues like management, a final list was arrived at. However, we are still excluding some names from this list as they have recently been figured as our picks of the fortnight.

article