Surajeet Das Gupta in New Delhi

Adages abound about how even a short period, say a week, can be a long time in certain walks of life, say politics.

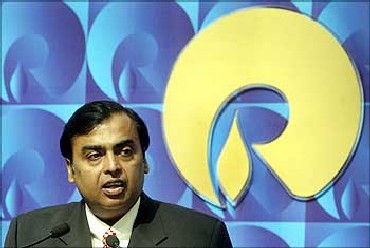

Try saying that to Mukesh Ambani, who runs the country's largest company by market capitalisation. Or to Sunil Mittal, whose company is the largest in mobile telephony.

About nine years ago, Ambani got personally involved in telecommunications to realise his father's vision of making a call cheaper than a postcard, and, of course, to make a lot of money while doing so.

As he plumped for the CDMA technology to carry his data-driven business plan, he found himself going eyeball-to-eyeball with Sunil Mittal, the leader of the GSM pack.

...

4G battle heating up: It's Ambani versus Mittal

Much has changed since then: There has been consolidation, yet the market place has got crowded with the entry of newer and newer players, it is easy to make a call cheaper than a postcard if you count the seconds, and a telecom minister is in Tihar along with a bunch of telecom executives.

But Ambani may be forgiven for wondering what has really changed.

Having given telecom to brother Anil in the family settlement six years ago, he is back in the sector, back with his data dream, and back to squaring up against Mittal.

The battle ground this time, though, is the fourth generation of telecommunications, or 4G.

Ambani's Reliance Industries, which bought 95 per cent equity in Mahendra Nahata's Infotel soon after the company became the only one to obtain a pan-India licence in the government's auction of broadband wireless access (BWA) spectrum, is quietly getting ready to launch its long-term evolution (LTE) services in January.

LTE services offer speeds of 5-15 mbps, faster than 3G networks.

...

4G battle heating up: It's Ambani versus Mittal

Photographs: Vijay Mathur/Reuters

Mittal's Bharti Airtel managed to win BWA licences in four circles - Maharashtra, Karnataka, Kolkata and Punjab - but is not content with that.

Although the company refuses to comment, Mittal is believed to be in talks with US telecom company Qualcomm to buy its BWA licences in four other circles, including the lucrative Delhi and Mumbai, apart from Kerala and Haryana. Qualcomm, which paid Rs 4,912 crore (Rs 49.12 billion) for these circles, may seek a premium over this from Bharti, say people who claim to be aware of the talks.

Ambani, though, appears to be moving ahead with vengeance. While the company refuses to discuss this, people who are closely watching RIL's moves say it is already in negotiations with leading telecom equipment companies Huwaei, Ericsson and Nokia Siemens to buy equipment worth $1-1.5 billion.

"We expect the order to be shared among the equipment makers. Currently, we are demonstrating our expertise to the company," said a senior executive of an equipment maker in the fray.

...

4G battle heating up: It's Ambani versus Mittal

Vendors say the order may take another two to three months to be finalised. According to them, Reliance may begin the services in a symbolic way in January in just a few cities in order to demonstrate what the new technology can do.

The company has also approached many telecom infrastructure companies with plans to lease 60,000 towers in two years for a pan-India rollout. Talks have been on with brother Anil, too, to lease his Reliane Communications' fibre optic backbone.

RIL's telecom venture is developing an array of applications, such as, broadband television, educational courses, and something which will offer solutions to enterprises.

Says a person close to the group, "In LTE mobile consumers should have applications on offer which help them in their life and work. That is the key." In the initial stage, its 4G service is likely to come in dongles, to be followed by mobile phones and tablets, among others.

...

4G battle heating up: It's Ambani versus Mittal

Photographs: Reuters

Not to be left behind, Bharti has pressed the speed button. Mittal says the company already has a network which is LTE-ready, though detractors argue that he still has to put in some more software and equipment in it.

To augment its expanse of circles, which will go up to eight if talks with Qualcomm fructify, the company is in talks with other LTE operators like Aircel and Tikona, which have 3G spectrum in circles where Mittal is not present - for roaming agreements so that its subscribers do not feel the pinch just because the company does not have a pan-India licence.

According to Miital, he has an edge because his networks straddle the 2G, 3G as well as the 4G space, something his competitors cannot boast of.

"You won't have customers only using an LTE device. He will use a device which works on various networks," he said in an earlier interview. He also expects to see more auctions of 4G spectrum in the near future.

...

4G battle heating up: It's Ambani versus Mittal

Photographs: Krishnendu Halder/Reuters

To push LTE, Bharti has tied up with China Mobile, Softbank and Qualcomm to create a global LTE initiative, which will create an eco system to popularise the service.

Mittal says he will launch LTE by the end of this year, starting with affordable prices of around Rs 10,000 for a dongle, which will seamlessly connect with the 2G networks.

Qualcomm is among companies which are working on chipsets which will make it possible for mobile phones to move across different networks. If you are using voice, it will use the 2G network; if you want data in a remote area, it will go for 3G; and when you want high speeds in congested commercial districts, it will move to 4G.

Bharti is banking on being the first to offer this service. Initially these phones could cost more than Rs 20,000. But most experts expect a fall in price once volumes rise.

...

4G battle heating up: It's Ambani versus Mittal

Photographs: Reuters

There are some obstacles which Reliance has to surmount. Currently, LTE only supports data, but that is changing.

LTE will also support voice over telephony and these mobile phones will be commercially available sometime next year, though they will not come cheap.

The current policy in India only permits internet telephony between two personal computers, but not between a computer and a phone. Until the policy is changed, voice over telephony won't make major sense for customers.

The challenge is to bundle various generations of services, on the lines of what Mittal is talking about.

...

4G battle heating up: It's Ambani versus Mittal

Photographs: Reuters

Reliance can do that if it ties up with any of the existing networks, if trading of spectrum in 2G and 3G is allowed by the government, or if it buys one of the 2G operators in the market.

Ambani, though, has his own advantages. He has the cash and can set up networks much cheaper than others because network prices have fallen; he can get a chunk of the infrastructure under lease, reducing overall cost.

He has done this before. His Rs 500 package called Monsoon Hungama, offering CDMA handsets with bundled minutes, caught the fancy of consumers and put a mobile phone in every other hand. And that's not the only thing that evokes d j vu. There is always Mittal.

article