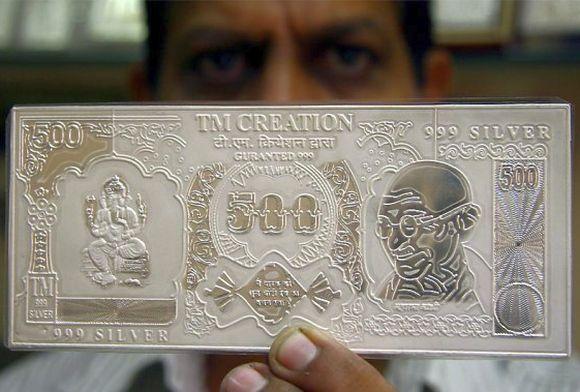

Photographs: Ajay Verma/Reuters

The rupee recovered after touching the key psychological level of 57 to the dollar on Thursday, helped by dollar selling by some foreign and custodian banks, but sentiment remains cautious ahead of key US data on Friday.

The initial fall pushed the rupee frighteningly close to a record low hit nearly a year earlier as fears of an end to the US Federal Reserve's monetary stimulus sent the dollar higher.

Recent US economic data has been mixed, which has left investors caught between fears the Fed will reduce its stimulus and worries the U.S. economy is still weak.

"The US data has been weak past few times and if that continues tomorrow, expectations of Fed withdrawing the stimulus will be hampered," said Pramod Patil, assistant vice-president, forex and money markets, at United Overseas Bank.

The rupee is not far off the record low of 57.32 hit in late June last year, raising the prospect of a potential intervention from the Reserve Bank of India, although most analysts do not expect bold actions given that the rupee weakness is tracking global factors.

. . .

Rupee recovers from near one-year low; RBI keeps watch

Still, further falls are bound to revive concerns about funding India's current account deficit.

The government on Wednesday increased import duty on gold, and the finance ministry is looking at raising the cap on foreign investment in sovereign debt.

"The psychological level of 57 has been hit and thus it invites fears of some intervention. The market is a bit cautious at these levels," said Paresh Nayar, head of fixed income and foreign exchange trading at First Rand Bank.

The partially convertible rupee closed at 56.84/85 per dollar, after earlier touching 57, its weakest since June 28, 2012. The rupee had closed at 56.7250/7350 on Wednesday.

Domestic shares fell on worries about the Fed stimulus programme, tracking Asian indexes that slipped to new 2013 lows.

The benchmark BSE Sensex closed down 0.25 per cent.

Traders also cited heavy dollar demand from oil refiners, the largest buyers of the greenback in the domestic currency market in early trade but dollar selling by foreign and custodian banks helped the unit recover.

. . .

Rupee recovers from near one-year low; RBI keeps watch

Image: An employee counts US dollar notes at a money changer.Photographs: Beawiharta/Reuters

Comments from a senior government official hurt the rupee as well. Propping up the rupee ‘artificially’ is not the right thing to do, said Montek Singh Ahluwalia, the deputy chairman of the country's Planning Commision.

The rupee is expected to hold in a 56.70-57.10 range until the U.S. non-farm payroll data, traders said.

The data is due after India market close on Friday and the reaction would be seen on Monday.

Domestically, investors are expected to focus on inflation, trade, and industrial output data, all of which are expected ahead of the Reserve Bank of India's policy review on June 17.

Expectations that the central bank would cut interest rates a fourth time this year have been recently dashed after Governor Duvvuri Subbarao expressed concern over retail inflation and the current account deficit.

In the offshore non-deliverable forwards, the one-month contract was at 57.20, while the three-month was at 57.78.

In the currency futures market, the most-traded near-month dollar/rupee contracts on the National Stock Exchange, the MCX-SX and the United Stock Exchange all closed around 56.99 with a total traded volume of $5.3 billion. (Editing by Prateek Chatterjee and Jijo Jacob)

article