Analysts remain confident RIL's refining and petrochemical segment will continue to support growth.

In the next few years, Reliance Industries (RIL) is expected to focus on segments such as telecom and upstream (oil).

However, the company’s financial performance so far and analysts’ expectation for the next few quarters show its core business -- refining and petrochemicals -- will continue to run the show.

“The core business has been the key contributor and it will continue to be so for the next year or two. The outlook for these businesses remains healthy,” said an analyst with a domestic brokerage firm, who did not wish to be identified.

The company announced plans to invest Rs 40,000 crore (Rs 400 billion) in its upstream business, along with its partner BP plc and also plans to sell low-cost feature phones in its telecom business.

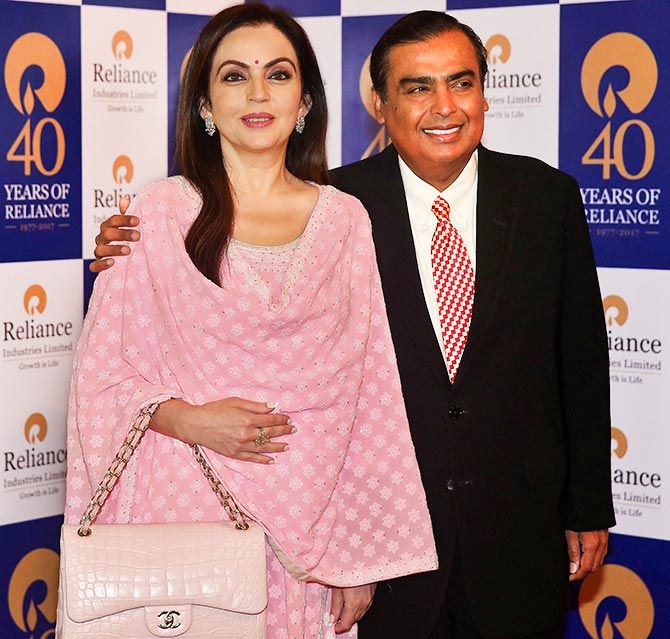

Mukesh Ambani, chairman and managing director, at the company’s annual general meeting said the focus would be to grow the company’s new businesses to the size of its existing businesses.

While it may be early to comment how RIL’s exposure to media and entertainment, upstream and telecom will fare in the coming years, analysts remain confident its refining and petrochemical segment will continue to support growth.

This was evident in the company’s financial performance for the June 2017 quarter.

For its pet-chem business, the company witnessed a 43.6 per cent rise in earnings before interest and tax (Ebit), while Ebit for the refining business was up 13 per cent.

In the consolidated Ebit of the company, pet-chem was the highest contributor to the incremental growth, followed by the refining business.

The pet-chem business saw a record Ebit at Rs 4,031 crore (Rs 40.31 billion).

The company in its presentation added cash flows from this segment will improve with completion of its large capital expenditure programme.

“Expect a sharp jump in depreciation and interest on commissioning of core projects in refining and petchem which may slowdown the earnings growth.

"We remain positive on the structural strength of RIL’s core business,” analysts with Emkay Research wrote in their results review note.

However, not many see the rise in depreciation on account of the commissioning schedule to be a major concern.

“The core business will still drive growth for the company in spite of the expected rise in depreciation,” said the analyst earlier quoted in the story.

For the April-June quarter, the company reported gross refining margins (GRM) at $11.9 per barrel, a nine-year high.

The company’s GRM have been in the double-digit range for the last 10 quarters and the management remains positive its margins would be sustainable in the long run.

“The management is expecting these to be sustainable given global capacity addition in refining is not happening at the same pace as demand growth.

Even if someone was to plan to add a capacity today, it will take a longer time to start servicing demand. The refining business looks to be a steady cash flow from a five-year horizon,” said a second analyst who did not wish to be identified.

The company in its results presentation added, “Oil demand growth outlook has improved further to 1.4 mb/d in 2017. Oil demand growth outpacing net refinery capacity additions in 2017 should support margins.”

In its refining business, the company also witnessed a rise exports, seen at $4.8 Billion in the June quarter, higher from $4.2 billion in the same period a year back.

Photograph: Shailesh Andrade/Reuters.

© 2025

© 2025