Oppo is the second Chinese brand after Xiaomi to secure single-brand retail licence. Xiaomi has now 600 retail partners.

Setting up of company-owned retail stores may prove to be vital for Chinese handset maker Oppo’s survival in the highly competitive smartphone market in India.

The firm, which recently received clearance from the Foreign Investment Facilitation Portal, may now divert some of its funds towards building a strong, controlled retail distribution set-up, rather than spending heavily on incentives to its trade partners.

While Oppo joins its Chinese rival Xiaomi in becoming the second handset firm from the neighbouring country to secure a single-brand retail licence, its implications could exceed the obvious benefit of having branded stores. The firm has faced stiff competition in recent months.

As Xiaomi opened its first offline store, Mi Home in Bengaluru, Oppo and its sister concern Vivo saw their sales dwindle in July and August.

According to industry estimates, their sales declined 30 per cent, year-on-year, thanks to Xiaomi’s aggressive expansion in the offline retail space.

Xiaomi, apart from appointing distributors for 11 cities like Delhi, Chandigarh, Jaipur, Hyderabad and Bengaluru, also tied up with all modern retail chains and over 600 retail partners that prominently display and sell its handsets. The firm, which now holds the second spot in the smartphone market with a 17 per cent share, plans to open 100 Mi Homes by 2019.

The stores not only help the company attract more potential customers but also allow it to have better control over its inventory, display of its new products and forward planning in production, according to Manu Jain, vice-president, Xiaomi. Jain said fixing supply-side issues in recent months had helped Xiaomi post 328 per cent growth during January-June from the same period a year ago.

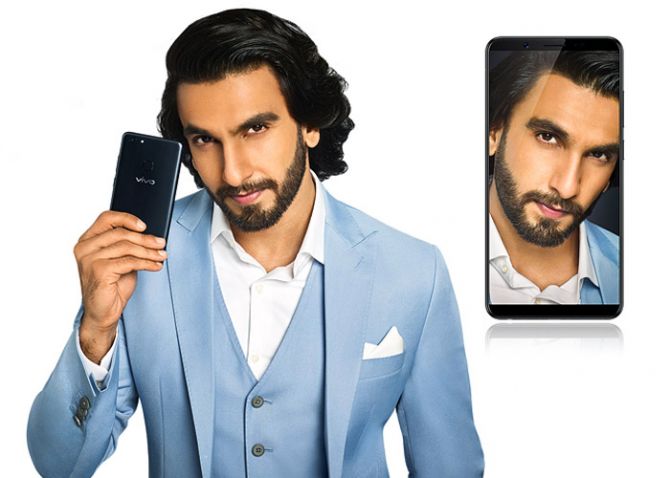

Oppo and Vivo, the two brands from Chinese technology major BBK Technologies, have aggressively expanded their offline presence during the past two years.

However, this has come at the cost of higher retailer margins. While most prominent brands in the market pay 8-10 per cent of the selling price to retailers, the two offered close to five per cent more to secure better display at stores.

Higher margins also translated into higher sales to some extent with a push from the retailers’ side.

However, according to experts, this is not a sustainable proposition in the long run. “While one may gain market share by offering higher margins and marketing spends, to sustain in this competitive environment, one has to find another way. For manufacturers, margins are under pressure anyway,” a senior executive with a leading manufacturer said.

Oppo declined to reveal its investment plans but it said in an email reply: “India has become the most important market for Oppo besides its domestic market and we have always focused on being present across all touchpoints to offer the best services to our consumers. We have offline stores across the country to provide our consumers better services in the process of purchase and with this development we will continue to enhance the offline presence to connect with more and more consumers.

"Now we have opened more than 200 Oppo Showrooms. In the future, we are going to increase the number of Oppo Showrooms to let consumers get a closer experience of our products,” it added. Oppo Showrooms are the company’s official stores.

According to Tarun Pathak, analyst with Counterpoint Research, while securing prominent display spaces in retail stores is becoming tough due to competition, major brands like Apple and Vivo -- both have applied for retail licences -- are looking to set up own stores.

Close to 200 brands are fighting for retail space in the conventional distributor-retailer channel, which has only given retailers an upper hand as they now seek a premium for pushing any particular brand.

© 2025

© 2025