Sebi also allowed foreign investors to own up to 15 per cent stake in domestic stock and commodity exchanges

Seeking to deepen capital markets, regulator Sebi, on Friday, offered direct entry to well-regulated foreign investors for investing in corporate bonds and relaxed the norms for raising funds through infrastructure and real estate investment trusts.

At the same time, Sebi also unveiled a number of steps to check misuse of private equity agreements for grant of share price-based remuneration and proposed to ban use of bulk SMSes, emails and new-emerging techniques like games, competitions and trading leagues for luring the gullible investors into fraudulent activities.

Sebi also allowed foreign investors to own up to 15 per cent stake in domestic stock and commodity exchanges, a move that is expected to help attract more overseas funds.

Currently, foreign entities can hold only up to 5 per cent stake in an exchange. The move will also help the two leading stock exchanges BSE and NSE in their proposed IPOs.

The slew of measures were approved by Sebi at a meeting of its board, which also cleared a proposal to allow companies to allot more shares for their employees during public offers, by hiking the limit for the value of such allotments to Rs 500,000, up from Rs 200,000 currently.

In another step aimed at improving ease of doing business, Sebi decided to provide permanent registration to merchant bankers, investment advisers, research analysts and eight other categories of market intermediaries.

The Securities and Exchange Board of India (Sebi) already gives permanent registration to stock brokers and sub-brokers subject to their compliance with certain requirements.

To improve access to investors in the north-eastern region and spread financial literacy, the capital market regulator also approved setting up a new office in Agartala.

It will also establish an office at Vijayawada, the new capital of Andhra Pradesh.

Making REITs and InvITs more attractive for raising capital, Sebi has now decided to allow them to invest in two-level (special purpose vehicle) structure through holding company.

It also removed the limit on the number of sponsors.

Currently, three sponsors are required.

Further, holding company would be allowed to distribute 100 per cent cash flow realised from underlying SPVs and at least 90 per cent of the remaining cash flow.

Regarding REITs, Sebi proposed to allow such trusts up to 20 per cent investment by such trusts in under-construction projects, up from a maximum of 10 per cent allowed currently.

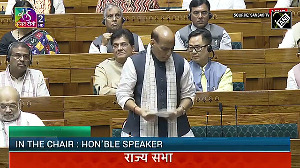

Photograph: Reuters