Set for the fifth straight year of fall in 2015, the rupee seems to have found a new bottom after hovering between two extremes of being billed the world's worst as well as the best performing currency and the experts see the range of 65-70 as the new normal.

Set for the fifth straight year of fall in 2015, the rupee seems to have found a new bottom after hovering between two extremes of being billed the world's worst as well as the best performing currency and the experts see the range of 65-70 as the new normal.

While the government announced a slew of steps and the Reserve Bank also intervened on a few occasions to support the forex market, a highly volatile trend continued to rule the exchange rates due to global headwinds through 2015, during which the Indian currency also hit a two-year low below Rs 67 mark against the US greenback.

It is expected to end the year between Rs 66-67 level, down more than five per cent from its 2014-closing level of Rs 63.03 to one US dollar.

It closed at Rs 66.21 in its last trading session, while four days of trading are left in 2015.

The major factors triggering the downward move included a substantial fall in foreign portfolio investments as an uncertainty prevailed for almost entire year over the

long-awaited rate high in the US and the slowdown in China, a major driver of global economic growth for last few years.

For most part of the year, rupee remained the worst performing currency globally, but a sharper fall in many other currencies may actually help the Indian currency end the year as among the relatively better performers.

Experts say rupee may actually end up as one of the 'best' performers among major currencies due to its much steeper yearly fall against the US dollar.

Euro is down nearly 16 per cent, while Indonesian rupiah is being billed as the worst performer.

Chinese yuan has also not done well.

The traders expect rupee to trade in the range of 65.50-70.00 against the US dollar in the year ahead.

Rupee's performance will largely depend on global risk sentiments and the domestic reform push, said Abhishek Goenka, CEO of IFA Global, which deals in forex and risk management.

The global risk sentiment would continue to be shaped by the Fed Policy, recovery in Chinese and Eurozone economy, he added.

The forex markets were largely dominated by the actions of central banks, including the US Federal Reserve, this year.

While Fed has finally decided to end its protracted period of near zero interest rate policy, the rate hike of 25 basis points came at the fag end of the year and speculation is already abound about its next move.

Another major factor dominating the global markets during the year was the collapse of Chinese equity markets and slowdown in its economy.

The Shanghai composite fell nearly 40 per cent within a span of few weeks trapping many retail investor and corporate profits began to shrink owing to poor global and domestic demand and oversupply.

The Indian rupee, which was being seen as stabilising in the range of 63-65 in the early part of the year, soon hit on a downward path after a devaluation of the Chinese Yuan by around 4 per cent sent the Asian currencies into a tailspin.

On the domestic front, the Reserve Bank initiated several steps to support the Indian currency.

The RBI increased FPI investment limit in fixed income markets, allowed importers to raise trade credit in Indian rupee from overseas, allowed companies to raise rupee denominated debt overseas and also showed its intent to intervene in Exchange Traded Currency Derivatives segment.

The government too played its part by relaxing foreign direct investment caps in certain sectors, moving certain sectors to automatic route from approval route, improving indirect tax collections and initiating PSU stake sale, all of which failed to contain the fall in rupee.

FPI inflows tapered in 2015 as compared to the previous years, which became one of the biggest factors for the rupee depreciation.

Though India's trade deficit shrank as compared to the previous year, exports have contracted for 13 straight months.

However, FDI flows have been relatively better.

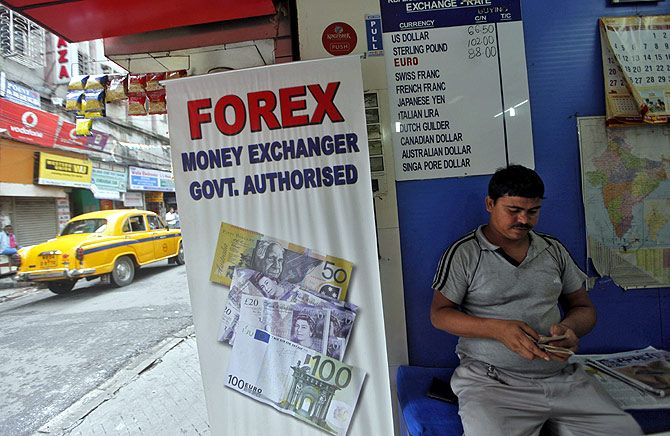

The image is used for representational purpose only. Photograph: Rupak De Chowdhuri/Reuters

© 2025

© 2025