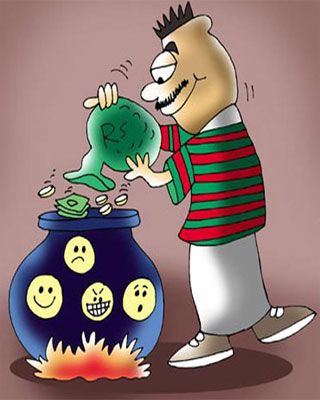

Capital markets regulator, I-T department suspect tax evasion and market manipulation

The Securities and Exchange Board of India (Sebi), the income-tax department and the special investigative team (SIT) on black money are learnt to be spearheading a multi-agency probe into an alleged flow of unaccounted money through 100 listed companies.

The Securities and Exchange Board of India (Sebi), the income-tax department and the special investigative team (SIT) on black money are learnt to be spearheading a multi-agency probe into an alleged flow of unaccounted money through 100 listed companies.

According to sources, Sebi is examining the role of these companies in misuse of the exchange platform to launder money and evade taxes. In the near term, the regulator might pass an order against 25 of those. Considering the number of companies involved, regulatory estimates peg the quantum of the alleged scam at close to Rs 20,000 crore (Rs 200 billion).

The companies include Pearl Agriculture, Pearl Electronics, Greencrest Financial Services, Global Infrastructure and Finance, Mishka Finance and Trading, Dhanleela Investment, Mahan Industries, Prabhav Industries and Advance Technologies. Most of these stocks are penny counters. Queries sent to the companies elicited no response.

Revenue secretary Shaktikanta Das, while talking about black money stashed abroad by Indians, had recently referred to unaccounted money present in the domestic market. “The quantum of domestic black money is equal to the money stashed abroad,” Das had said.

The SIT on black money has already taken the case on record. “We had received a reference from the income-tax department that the promoters of certain low-value listed companies are using the stock exchange platform to get an advantage of long-term capital gains (LTCG) and evade taxes. The probe against some companies is currently underway,” said a source privy to the matter.

The modus operandi is believed to be similar to the one seen in the cases of Radford Global and First Financial Services. In an order passed last week, Sebi whole-time member Rajeev Kumar Agarwal had barred 260 market entities, including two companies, their promoters, brokers and a clutch of investors, from accessing the securities markets.

The regulator has accused these entities of misusing stock exchanges to generate long-term capital gains of around Rs 485 crore, and converting unaccounted cash into legitimate money.

Acording to initial investigations by Sebi, these 100 companies ‘exist only on paper’ and are using the exchange platform to convert ‘black money into white’. These firms, thanks to the clause of a compulsory one-year lock-in on shares issued through the preferential route, were eligible for LTCG on any gains made on sale of these shares. The regulatory probe is determining the role of traders and operators that acted in concert with promoters to artificially rig volumes and prices.

Another area of investigation the regulator is focusing on is to determine whether the funds infused into the companies by way of preferential allotment was utilised for purposes other than those disclosed, and if money for purchase of shares passed through a number of entities before being used to buy shares.

“Probe is underway to verify whether these companies and related entities carried out trading among themselves to manipulate share prices, before and after preferential allotment,” said a source.

In its order dated December 20, Sebi had noted that the promoters of two companies had malafide intent. “The modus operandi of allotting shares on a preferential basis at a premium, pumping the share price artificially and then dumping the price so that the same cycle could be repeated, demonstrates the malafide intent of the Radford Group & suspected entities. Also, the mechanism is being presumably used to deceive the authorities by laundering black money and raking in tax-free profits,” said Agarwal.

Checking the books

- Scam of Rs 20,000 crore in listed space being probed

- Enquiry on by several agencies, including the SIT on black money

- About 100 companies under scanner; most of these ‘exist only on paper’

- The Securities and Exchange Board of India might pass an order against 25 of these companies

.jpg)

© 2025

© 2025