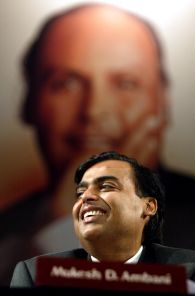

Mukesh Ambani-led Reliance Industries (RIL) may soon consider ways to reward shareholders, again. In their report on RIL, Nilesh Banerjee and Vikas Jain of Goldman Sachs India said: “Our discussion with the company indicates that following the share buyback last year, the management is open to considering ways to reward shareholders again.

In their report on RIL, Nilesh Banerjee and Vikas Jain of Goldman Sachs India said: “Our discussion with the company indicates that following the share buyback last year, the management is open to considering ways to reward shareholders again.

However, this is likely to happen only next year because according to the new guidelines of the Securities and Exchange Board of India (Sebi), a company cannot conduct another share buyback before 12 months from the date of conducting one. For RIL, the 12-month cool-off period ends in January 2014.

On February 7, 2012, RIL launched the largest-ever share buyback programme by any Indian company.

According to its annual report, RIL bought back 46.24 million shares worth over Rs 3,366 crore (Rs 33.66 billion) from public shareholders.

An RIL spokesperson declined to comment on the options the company would consider to reward shareholders.

Analysts estimate RIL will return about $3 billion cash to shareholders over FY14-17, implying a low dividend yield of about 1 per cent.

“RIL has the scope to return more cash to shareholders despite heavy committed capex. Despite investing heavily in its core business expansion over FY13-17, we believe RIL can still consider returning more cash to its shareholders,”

According to them, RIL has a cash balance of $15.7 billion as of the first quarter of this financial year. They expect significant free cash flows to the tune of more than $5 billion in FY17, which warrants a better capital allocation policy for shareholders.

The analysts recommended that RIL’s treasury stock accounting for about 9 per cent of its outstanding shares should be cancelled to reward shareholders, given the company’s strong balance sheet.

“Cancellation of at least part of the treasury stock could be another way to reward shareholders.” RIL holds 292 million treasury shares on its books. The shares were created after the merger of Reliance Petroleum (2002) and Indian Petrochemicals (2007) with the RIL group.

“While the treasury stock provided the company with an option to raise equity capital without dilution in the past, we believe this is now not necessary given the strength of RIL’s balance sheet,” Banerjee and Jain added.

Goldman Sachs calculated the cancellation of the treasury stock could lead to a decrease in the outstanding common share base by 9.1 per cent.

Of the outstanding shares, 17.2 million held by subsidiaries and not carrying voting rights can be immediately cancelled.

© 2025

© 2025