Today, people are happily raising 80-85 per cent through home loans, and if they still don't have enough, the rest is raised through a personal loan.

A typical home buyer in the 1970s was someone in his late 50s, waiting for his provident fund money to buy a house.

If lucky enough, he would have saved some to part-finance the property or arranged a nominal loan from a friend or relative.

"Forty years back, property buying happened usually a couple of years before retirement. It was in many ways a final deed," says J S Augustine, a consultant with ACME Group.

Buyers were not demanding at all. As Niranjan Hiranandani, Chairman, Hiranandani Group who started operations in the mid-70s, reminisces: "Buyers in those days had only one request. Please give a house that does not leak."

Fast-forward to now. People are buying properties even in their 20s. In fact, some start by buying small properties in remote areas, and move their way into the city over time.

This change is reflected in the rising figures of physical savings. According to data from the Reserve Bank of India, in the 1970s the rate of physical savings as a percentage of the gross domestic product stood at 6.9 per cent.

This number improved to an average of 12.7 per cent in the period between 2003-04 and 2006-07. As RBI Deputy Governor Rakesh Mohan pointed out in a 2008 lecture, the household sector's investment rate (physical savings) has increased because of the availability of housing finance.

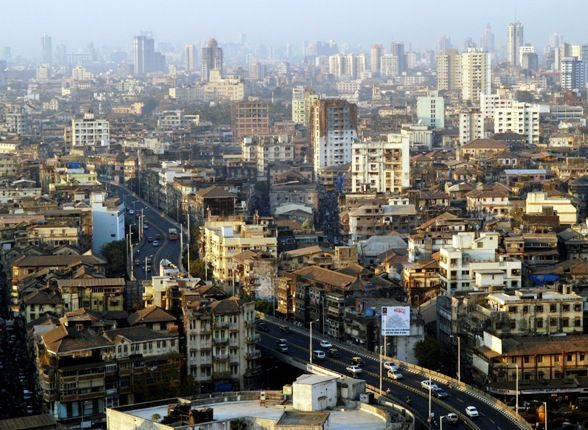

Photograph: Reuters

Today, people are happily raising 80-85 per cent through home loans, and if they still don't have enough, the rest is raised through a personal loan.

No wonder, banks and housing finance companies are tapping youth aggressively. And, of course, being leak-proof isn't enough any more for the attractiveness of a property - gymnasiums, clubhouses and small parks have become a norm.

The single biggest reason for the change in aspiration is the availability of housing finance.

The entry of Housing Development Finance Corporation in 1978, brainchild of H T Parekh, former ICICI chairman and paternal uncle of Deepak Parekh, made home buying much easier.

Over the years, institutions like ICICI Bank, State Bank of India and others have emerged as strong players.

One big problem with real estate transactions was the black money component. So much so that HDFC did not lend more than Rs 70,000 for many years. Explains a senior official: "The agreement value would be much lower than the actual transaction amount. So, we introduced a system whereby our technical people would go to the site and come up with what we called appraised value. In effect, in early days, we funded most of the agreement value."

The undervaluation was so high that people would report property 50-60 per cent lower than the actual deal price.

Interestingly, the black money component gave birth to new income tax sections 37E and 37I.

"Once you made a deal to buy a property, you had to register it with the income tax department. Within a month, the department either gave you a no-objection certificate or they acquired the property based on the built-up area price," says Pranay Vakil.

The minimum value in metros and non-metros were revised upwards several times. Due to this law, the department ended up having a portfolio of properties, which it auctioned from time-to-time. The sections were repealed in 2002.

To counter black money and under-reporting, the government is bringing rates in ready reckoner at par with the market value.

Ready reckoner is a state's reference rate for properties, based on stamp duty collection. If the deal happens below these published prices, buyers and sellers need to pay taxes.

To make property transactions easier for buyers, the government has also done away with the Urban Land Ceiling Act (ULCA), introduced in 1976.

The Act said if a person held property of more than 5,000 sq metres (53,820 sq ft) in metros, he needs to declare it. The excess land could be taken by the government for various social causes like low-cost housing.

If the permission was granted for construction, the developer was not allowed to construct more than an 80 square metres (around 862 sq ft) flat in tier-1 cities.

Builders found a way around this, by splitting flats on paper. Many did two or three agreements with buyers for the same house.

The document showed the person bought more than one unit. The Act was finally abolished by many states over the past decade.

The need to scrap ULCA became necessary as buyers' profile evolved with time. Economic growth saw the average age of a person purchasing a house come down from the early 50s to the mid-30s.

In cases where both partners are working, they went for bigger houses at an early stage of their careers.

While most developments of the past four decades have been in favour of buyers, the period also saw changing definitions of saleable area.

Classically, houses were sold on carpet area alone. In the 1970s realty players started selling houses on built-up area. "With time, newer concepts evolved such as super built-up area and the recent one is jumbo area," said Vakil. In the latter, the loading is 70 per cent or more.

Buyers are also at the losing end when it comes to dealing with builders. Unless consumers go for a known brand, they can never be sure of what could next hit them.

There have been numerous cases of indefinite project delays, consumers getting a smaller area than the mentioned in the agreement, and builders asking buyers to pay more money if prices see a steep rise while a property is under construction.

© 2025

© 2025