| « Back to article | Print this article |

Wake up Sid! This film showed the state of mind of a youngster who is in dilemma of how to go about his career and life. Imagine a college graduate having his savings account credited by his own salary, something that was till now being filled by his father.

Managing money is something that most Indian parents are not very comfortable teaching. Usually one hears, 'be satisfied with what you get'. While this is true it is equally important to make suitable arrangements for money with money. Let us understand this concept in detail.

Managing money is something that most Indian parents are not very comfortable teaching. Usually one hears, 'be satisfied with what you get'. While this is true it is equally important to make suitable arrangements for money with money. Let us understand this concept in detail.

Welcome to the world

In the English comedy serial "Friends", when Rachel decided to get a job and start earning, Monica says - "Welcome to the real world! It sucks! You're going to love it". This is applicable for the fresh graduates who have all the zeal and drive to prove themselves and create an identity in the business world. Getting a job and earning "my own money" seems to be the only goal in life. There is a long list of things to be done and bought with the first salary.

Saving and investing is done not as a voluntary decision but money is committed as something that is required to save tax.

Market vagaries like Sensex crossing 21,00, and then falling to 8,000 within a span of a few months unnerve many would be investors.

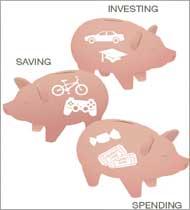

One needs to understand basic terms like earning, saving and investment instead of opting for the readymade "packages" that are prevalent. Take heart, it's not just the newcomers who find it difficult to strike the right balance, even experienced investors find the art of managing money a little difficult to grasp.

Habits

A word of caution for compulsive buyers. Irrespective of whether you have just started earning, or have been at it for a while, remember the most intelligent thing it to learn how to best use that money so that in times of emergency you can fall back on it.

Investing

Like we eat, we work, we sleep, we also need to invest. But first we need to understand the meaning of investing. These issues are not that simple but a bit of financial knowledge can make things much simpler. So, let's start!

An example will help us understand the whole process.

Mohit, working as an accounts executive has a net monthly income of Rs 45,000 (he gets this amount credited to his bank account after all deductions like provident fund and taxes.

He has monthly personal expenses of Rs 10,000 including conveyance and daily expenses. He devotes Rs 10,000 to his home. Finally he has Rs 25,000 each month at his disposal.

Mohit has now ato take a decision about this Rs 25,000 - to spend all now, to save all, spend some and save some - the options are endless.

Another point to be understood is that saving is one part and putting it in useful financial instruments is another. Buying all equities could be very risky and putting all money in FDs can be a waste for our young investor. Better idea is to match your investing with your time horizon.

If you have lot of time, invest more in equities, else have a balanced portfolio. The exact portfolio is relative to each person but having more exposure to direct equity and/or equity mutual funds is what is best for young people as they have long investing time and need an overall greater return.

So get cracking. Consult a financial advisor and ready a portfolio and be a disciplined investor.