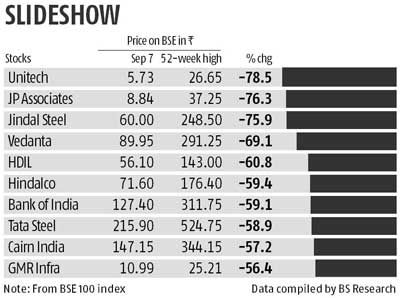

Oil and Natural Gas Corporation, Hindalco Industries, Tata Steel and Vedanta were down up to 70 per cent below their one-year highs.

A whole host of stocks are now available at 50 per cent discounts to their 52-week highs, following a near-12 per cent fall in the benchmark BSE Sensex over the past month.

A whole host of stocks are now available at 50 per cent discounts to their 52-week highs, following a near-12 per cent fall in the benchmark BSE Sensex over the past month.

A total of 151 stocks from the BSE-500, mid-cap and small-cap, are currently quoting at more than 50 per cent below their 52-week highs on the BSE exchange.

The Sensex has corrected 3,343 points, or 11.8 per cent, from 28,236 on August 7, to 24,894 on Monday, on the back of continued selling pressure by foreign portfolio investors.

The benchmark index was down 16 per cent from a record closing high of 29,594 on March 3.

Oil and Natural Gas Corporation, Hindalco Industries, Tata Steel and Vedanta were down up to 70 per cent below their one-year highs.

Among the BSE sectoral indices, metal is down 46 per cent, realty 36 per cent, oil & gas 28 per cent, power 27 per cent and the bankex 25 per cent down from their one-year peak.

The Indian equity market is very sensitive to foreign institutional investor (FII) flows. Over the past month, FIIs have taken significant money out of the Indian market, due to worries over the US rate hike and Chinese slowdown.

Since August 7, FIIs were net sellers of $3.4 bn (Rs 22,646 crore), according to NSDL data. Three Amtek Group companies -Amtek Auto, Castex Technologies (formerly Amtek India) and Metalyst Forgings -saw market value erosion of 80 per cent from its 52-week high due to fear of debt default.

100 stocks down 50% from 1-year highs Oriental Bank of Commerce, Bank of India, United Bank of India, Uco Bank and Indian Overseas Bank from the banking, Jaiprakash Associates, Housing Infrastructure and Development (HDIL), GMR Infrastructure, HCC and Reliance Infrastructure from the infrastructure sector stocks currently quoting at half of their 52-week high price.

© 2025

© 2025