| « Back to article | Print this article |

Until now, these platforms were either working through an investment advisory (IA) or stockbroking licence.

With the capital markets regulator set to allow online mutual fund (MF) platforms to charge a transaction fee, asset management companies (AMCs) are worried that the onus of paying the charge will ultimately fall upon them.

On Tuesday, the Securities and Exchange Board of India (Sebi) gave its nod to the execution-only platform (EOP) framework, specially designed for investment platforms that sell direct plans of MFs.

Until now, these platforms were either working through an investment advisory (IA) or stockbroking licence.

While the intricacies of the regulations are yet to come out, the regulator has said that such platforms will be allowed to charge fees on transactions.

This fee will either be paid by AMCs or investors and the investment platforms will get to decide who they want to charge, going by the consultation paper on the subject.

"If these online platforms decide to become AMC agents, our margins will get impacted," said a senior AMC executive.

"We don't know how much these charges will be. There will be negotiations if Sebi leaves it to us and these platforms. Whatever be the charges, the burden is likely to fall on us," said a chief executive officer (CEO) of another fund house.

CEOs feel that further expenses will be a further squeeze on their slim margins. Sebi has set the upper limit to how much expenses they can charge.

AMCs hope these platforms will choose to become agents of investors and charge them the transaction fee.

"They should ideally go with investors. Or else, we may end up having to negotiate with each of them and whichever player enters the business," said the CEO of a large AMC.

In line with the EOP framework, these platforms will have two options.

They can either register with the Association of Mutual Funds in India (Amfi) and become an agent of an AMC or register as stockbroker and become an agent of the investor.

Keeping in mind the consultation paper, if they empanel with Amfi, they can charge AMCs.

And if they register as a stockbroker, they can bill investors.

"Fee structure for EOPs as an agent of AMC to be transaction based. A suitable cap can be prescribed on such fees while acting as agent of investors," the regulator had proposed in the consultation paper.

Apart from the opportunity to monetise their platforms, the EOP framework will ease the compliance burden on these platforms.

Since they now work through IA or a stockbroking licence, they have to abide by the compliance requirement of these complex businesses, even though their business is much simpler.

"It separates the IA regulations from the execution of direct plan transactions. Essentially, it makes it cleaner for financial technology platforms to plan for and provide direct plan execution services," said Gaurav Rastogi, CEO, Kuvera.

However, other major MF investment platforms like Groww, Paytm Money, and Coin by Zerodha may not see any change in compliance since their MF platforms are an extension of their stockbroking business.

"The regulation is for businesses that are standalone MF transaction execution platforms. We have a stockbroking business and do not plan to charge for transactions any time soon. Nothing changes for us," said Bhuvanesh R, assistant vice-president (business), Zerodha.

All direct MF investment platforms have been free for users until now.

Their zero-fee structure, coupled with the ease of investing, has led to their popularity.

They have also played a key role in the growth of the MF industry in recent years.

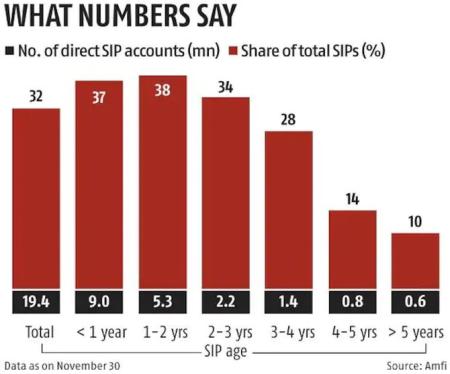

Going by Amfi's November data, 37 per cent of systematic investment plan (SIP) accounts that are less than three years old are direct plans.

Overall, their share in total SIP accounts is 32 per cent and has been rising steadily.

Online MF investment platforms like Groww, Coin by Zerodha, Paytm Money, Kuvera, and ET Money are the most popular platforms for direct MF investment.

The EOP framework will be applicable to platforms that provide both financial and non-financial services to MF investors.

Financial services will include the purchase and redemption of MF units, while non-financial transactions will include a change of email ID, contact number, and other details.