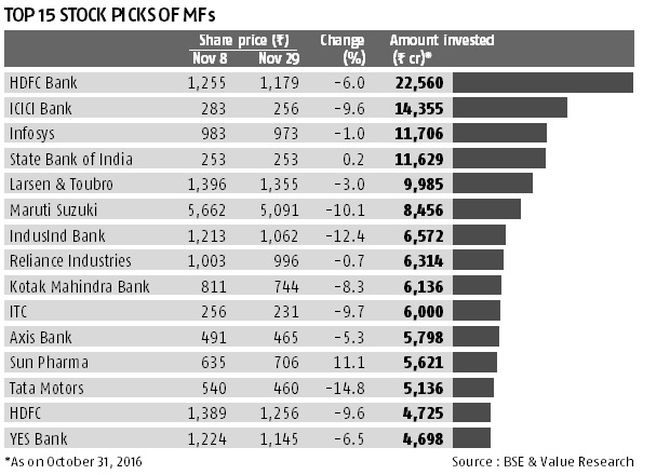

The average fall in 15 most-invested stocks by equity MFs was 5.7 per cent. Chandan Kishore Kant reports

The demonetisation move has impacted most equity mutual funds. While the benchmark BSE Sensex has declined 4.5 per cent since November 8, when currency notes of Rs 500 and Rs 1,000 were declared illegal tender, the average fall in 15 most-invested stocks by equity MFs was 5.7 per cent.

Nearly a fifth, or Rs 1.3 lakh crore, of MFs’ equity assets are invested in these companies, which include HDFC Bank, ICICI Bank, Infosys, State Bank of India and Larsen & Toubro.

Top pick HDFC Bank, which has investments in 227 equity schemes, has declined six per cent since November 8. It alone has cornered Rs 22,600 crore of the equity assets. Similarly, ICICI Bank (Rs 14,350 crore) is down nearly 10 per cent.

Stocks in the four-wheeler segment are the worst hit. Tata Motors and Maruti Suzuki, which collectively account for Rs 13,600 crore, have fallen 15 per cent and 10 per cent, respectively, denting net asset value of various equity schemes.

The only saviour, amid this mayhem, is Sun Pharmaceutical Industries. The stock surged over 11 per cent. The amount invested in the pharma major is Rs 5,600 crore, making it the 12th most sought after stock by equity fund managers.

© 2025

© 2025