Reserve Bank of India Governor Duvvuri Subbarao on Monday said the central bank should move towards setting up a monetary policy committee on the lines of the Federal Open Market Committee of the United States, but with certain pre-conditions.

Reserve Bank of India Governor Duvvuri Subbarao on Monday said the central bank should move towards setting up a monetary policy committee on the lines of the Federal Open Market Committee of the United States, but with certain pre-conditions.

Subbarao said a phased approach could be adopted but a 'legally-backed autonomous structure of the central bank is a necessary pre-condition.'

"My view is that we should move towards having an MPC, but in a phased manner.

He was addressing a meeting of the Central Bank Governance Group in Basel on Monday.

RBI has a Technical Advisory Committee on Monetary Policy.

Its role is mainly advisory.

TAC is headed by the RBI governor.

The deputy governor in charge of monetary policy is the vice-chairman. The other three deputy governors are members.

Under law, RBI does not have autonomy. The RBI Act says the government may give it directions after consulting the governor.

Subbarao said in reality, RBI functioned as an autonomous body and there had been no instance of the government exercising this power.

Subbarao said moving to the MPC system would become a realistic option once financial markets deepened further and monetary policy transmission became more efficient.

Without this, MPC could weaken co-ordination between the government and RBI, which could have a bearing on inflation, mostly driven by supply elements, he said.

Subbarao said even if the Financial Stability and Development Council had been set up, it was important for the government and regulators to develop conventions and practices to preserve financial stability without eroding the autonomy of regulators.

FSDC, set up in December 2010, comprises a sub-committee headed by the RBI governor.

Subbarao said RBI was expected to evolve as a more active, hands-on body to manage financial stability in normal times, while FSDC would have broad oversight and assume a central role in crisis situations.

FSDC is chaired by the finance minister.

Subbarao, who has completed more than two-and-a-half years in Mint Road, said financial stability was explicitly becoming the function of central banks after the 2008 global financial crisis.

Opposes separation of debt office

Subbarao opposed separation of the debt management office from RBI, being contemplated by the finance ministry.

He said the advantages of doing this were 'overstated'.

"The case for shifting the debt management function out of the central bank is made on several arguments such as resolving the problem of conflict of interest, reducing the cost of debt, facilitating debt consolidation and increasing transparency.

"These advantages are overstated."

It is said that RBI's role as the government's debt manager makes it biased towards low interest rates.

Subbarao said though these arguments were valid in some countries, in a country like India with large government borrowings, sovereign debt management was much more than an exercise in raising resources.

He said the size and dynamics of government borrowings had a much wider influence on interest rates, systemic liquidity and credit growth in India.

"Only central banks have the requisite market pulse and instruments to make contextual judgements which an independent debt agency, driven by narrow objectives, will not be able to do," he said.

Inflation targeting not feasible

Subbarao said in India, inflation targeting was neither feasible nor advisable, as it was not practical for RBI to focus exclusively on inflation oblivious of the larger development context.

RBI says efficient monetary policy transmission is necessary for inflation targeting to work.

In India, it is improving, but is a fair bit away from the desired level.

Factors that hinder policy transmission are an asymmetric relationship between depositors and banks, administered rates on postal savings which are not adjusted with trends and rigidities in the financial markets.

"These dampen the efficacy of monetary signals and complicate adoption of an inflation-targeting regime," Subbarao said.

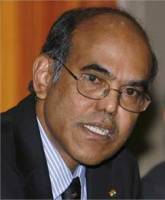

Image: Duvvuri Subbarao

© 2025

© 2025