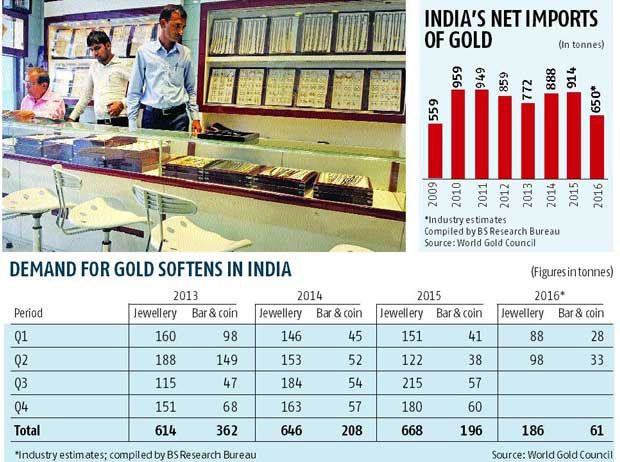

Imports in 2016 expected to be lowest in 7 years but experts don't rule out a revival in demand if the yellow metal's price falls

India's gold demand fell significantly in the first half of 2016. World Gold Council data show the combined demand for jewellery and investment at only 247 tonnes. Import during January-June was 248 tonnes, 42 per cent lower than the corresponding period last year and lowest since 2009.

Even in calendar years 2013 and 2014, when the trade was under severe regulatory stress in India, demand and imports were higher than seen in 2016 so far. Estimates peg imports in 2016 at 650 tonnes, after taking into account some recovery expected in rural demand, led by a good monsoon. However, this will be the lowest after 2009, when imports were 559 tonnes.

Notably, the trend has continued after June. Sudheesh Nambiath, lead analyst for precious metals at GFMS Thomson Reuters, said: "In July, imports fell 78 per cent year-on-year to 20.8 tonnes, the lowest since September 2013. Has the cycle of Indian gold imports hit the trough? Possibly, yes."

The outlook, say experts, is similar in August. The domestic price continues to trade $25 an ounce lower than the landed cost of imported gold, making imports unviable.

Bachhraj Bamalva, director, All India Gems and Jewellery Trade Federation, said: "Due to high import duty and several measures implemented by the government in the past few quarters to disincentivise black money, gold demand saw a huge impact and our estimate is that 2016 is likely to end with 650 tonnes of imports. If demand improves significantly, in the most optimistic scenario, imports might be 700 tonnes."

Apart from anti-black money measures like providing the income tax PAN for purchase of jewellery in cash above Rs 200,000 and excise duty on jewellery, a sharp increase in global gold prices and better returns in other asset classes like equities has lured buyers away. However, even as Indians are not buying as much gold as in the past, experts say one should not write off the yellow metal.

Jean-François Lambert, managing partner, Lambert Commodities, says: "So long as India is India, its love affair with gold will endure."

Christopher Wood of CLSA, a noted investment banker, says in his Greed and Fear report: "Though I am fundamentally bullish on gold, the fact is physical gold demand is low globally. Financial investors are driving demand."

In the first half of 2016, global gold-exchange traded funds (ETFs) purchased 580 tonnes of gold, more than combined physical demand for gold from India and China, which account for over half of global demand.

Uncertainty over global economic growth is driving demand for gold in financial markets. Several reports from the international market also suggest that speculation in gold-based financial instruments is rampant.

However, it is not a bubble-like situation. Lambert says, "With uncertainty in the markets, we saw a rush on gold earlier this year. So long as uncertainty remains (and it will - Brexit, US elections, slower global growth, etc) and unless gold flies much higher on pure speculative rationale, I do not see a big bubble bursting. Meanwhile, demand for physical (gold) should remain in tune with consumption growth in India and China."

For now, experts are cautious on the demand outlook in India. Nambiath said: "Retailers are very cautious. The response ahead of the Onam festival in Kerala in September will be a barometer on how demand is likely to turn out for the rest of the year, given the high per capita consumption of gold from this single state." He adds, though, that demand in India will rise if prices fall.

Most experts are keeping an eye on how the anti-black money measures work when demand resumes for festivals and the rural appetite post-harvest, expected to be better.

Says Nambiath, "Currently, the market is facing tight liquidity due to the income disclosure scheme and drive against corruption. Undisclosed income has been one of the key sources driving sales in jewellery and investment bars, as gold has been a safe haven to hide cash. It will be a wait and watch to see how the industry reacts in this situation."

Clearly, many variables are at work. Only time will tell if India's love affair with gold revives! Nevertheless, given the uncertainties, investors could consider buying some gold on dips, which will lend stability as also returns in the long run.

Photograph: Rupak de Choudhuri/Reuters