As wholesalers largely failed to meet GST norms, companies were in a fix. According to industry veterans like Sunil Duggal, chief executive of Dabur, the hazard led many to look beyond third-party distribution and take the leap to cover unattended markets directly.

Last year, ITC brought 300,000 retail outlets under its fold.

While its direct reach touched 2.5 million outlets by mid-2018, it is adding new territories with direct distribution.

The fast moving consumer goods (FMCG) conglomerate, which sells everything from notebooks and deodorants to branded flour and cigarettes, now plans to double up its reach by 2023.

Ayurveda major Dabur is working on similar lines.

It doubled its sales team last year by hiring 700 people to strengthen its rural distribution, which was largely dependent on wholesalers.

This year, the company has invested heavily in development of distribution infrastructure.

It had to cut allocations for bonuses and reduce spending on advertisement as well as promotions.

Industry leaders like Hindustan Unilever (HUL), Nestle and Patanjali, too, are gaining new grounds every quarter, where large players had never set foot on.

The recent push comes after implementation of the goods and services tax (GST) in mid-2017, which unsettled the wholesale distribution channel — disrupting business for months in the rural market.

As wholesalers largely failed to meet GST norms, companies were in a fix.

According to industry veterans like Sunil Duggal, chief executive of Dabur, the hazard led many to look beyond third-party distribution and take the leap to cover unattended markets directly.

The FMCG industry had been depending on wholesalers and sub-stockiest for decades to cater to the hinterland.

Till early 2017, over 35 per cent of their sales were coming from these third-party trade partners.

But finally, that structure is changing and for good reason.

The implications of this transformation are already visible, said experts.

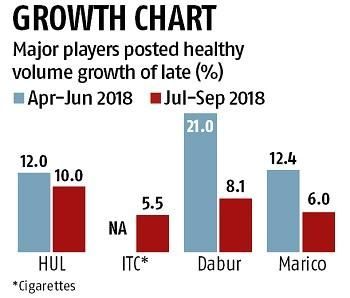

Dabur India, which saw subdued volume growth during the past few years, posted 21 per cent growth in volume sales in the June quarter.

Volumes expanded 8.1 per cent in September -- higher than 7.2 per cent in the corresponding quarter last fiscal year.

According to Edelweiss Securities, improving distribution reach played a key role in its recent performance.

Duggal told recently that Dabur is adding 400 people to its sales team that underwent realignment. "In the rural market, we divided the portfolio and team into health care and personal care, put in massive infrastructure, and increased the density. These measures have earned us rich dividends in recent quarters," he said.

B Sumant, president (FMCG) at ITC, said: "We are constantly adding the number of salesmen, which today stands at 40,000. In last three years, the number of distributors has gone up to 1,800 from 1,400, and over 100,000 villages are now covered (directly)."

ITC's cigarettes volume grew 5.5 per cent in September, beating Street estimates.

HUL has unleashed a distribution drive to better serve the most populated state Uttar Pradesh, where nearly 78 per cent of consumers reside in rural areas.

It now plans to drive sales of ice cream by expanding distribution in smaller town and rural markets, against the top 25 cities earlier, noted market analyst firm Antique Stock Broking.

HUL's earnings before interest, tax, depreciation and amortisation grew 20.3 per cent in the September quarter, compared to 5.2 per cent last year.

Volumes grew 10 per cent and 12 per cent in September and June, respectively, compared to 4 per cent in September last year.

Nestle India posted 30 per cent growth in net profit and 17.5 per cent in top line, backed by broad-base volume growth, it said.

The new era of growth followed decentralisation of decision-making in marketing, earlier in 2018.

The move, aimed at revamping market reach, led to the formation of 15 virtual teams in charge of the same number of clusters.

These monitor operations in the regions, decide on promotion and distribution, and send insights to headquarters.

According to Suresh Narayanan, chairman and managing director of Nestle India, the firm has increased direct reach since mid-2017 when GST became effective. It now reaches over 4.2 million outlets, compared to 3.5 million in late 2015.

Patanjali Ayurved, which depended heavily on branded outlets till 2017, is now going deeper into the market by adding mom-n-pop stores.

To strengthen its sales and distribution in general trade, Patanjali hired 11,000 field personnel in July and August, and is planning to double the number by the year-end.

The firm used to get 70 per cent of its sales from branded Patanjali stores till early-2018. It now wants to reach 3 million outlets by end-2019.

© 2024 Rediff.com -

© 2024 Rediff.com -