Domestic investment and consumption must pick up if India is to see serious GDP and earnings acceleration in 2015-16, says Devangshu Datta.

A few years ago, the creative national accounting practices of Greece sparked off a crisis across the euro zone and by extension, global markets.

Last Tuesday, Greek politics again led to spontaneous global contagion.

Fears arose that Greece would exit the euro, if the far-left Syriza Party won elections on January 25.

A sane assessment suggests the Euro zone is well-braced for a Greek exit (and maybe, well-rid of Greece).

But once panic (a Greek word) set in, prices went irrational.

The euro was hammered down to nine-year lows. Crude took a hammering as well. Brent fell 10 per cent in just two sessions.

Every major global equity index lost over 1 per cent on Tuesday.

Most lost much more. The Sensex-Nifty pair lost over 3 per cent.

There was a small recovery on Thursday and Friday.

But Monday may open weak again. US payroll data came in weaker than consensus and the Dow Jones closed with losses.

Net downtrends and high volatility across commodities could be a recurrent pattern in 2015.

A deflationary feedback loop now seems to be operating in crude. There is low demand for oil due to slow growth in Japan, Europe and China.

That in turn, has caused a crash in oil prices, which in turn, has triggered deflation and led to even lower demand for oil. Note, this is winter when central heating cause a seasonal peak in demand.

Along with oil, coal, gas, plastics, and non-precious metals have dipped. Low oil, gas and coal are blessings for India, which is a major energy importer.

It is a good time to work through the restructuring and equity disinvestment of the inefficient behemoth, Coal India Ltd (CIL).

There may well be more strikes and CIL could under-shoot production targets, necessitating higher imports.

But at least the extra imports will be relatively cheap. The flip side is, of course, flat export demand and lower remittances from Gulf workers.

Oil exporters could find their economies coming under increasing stress.

A crisis arising from some sort of default in an oil-export economy is conceivable.

Russia is in crisis, Norway's currency has hit 13-year-lows, Gulf real estate is falling in value and highly-leveraged.

In Malaysia, a state investor, 1MDB, defaulted on loan repayments in December last year.

India must reckon with the possibility that it will struggle to attract higher overseas investment.

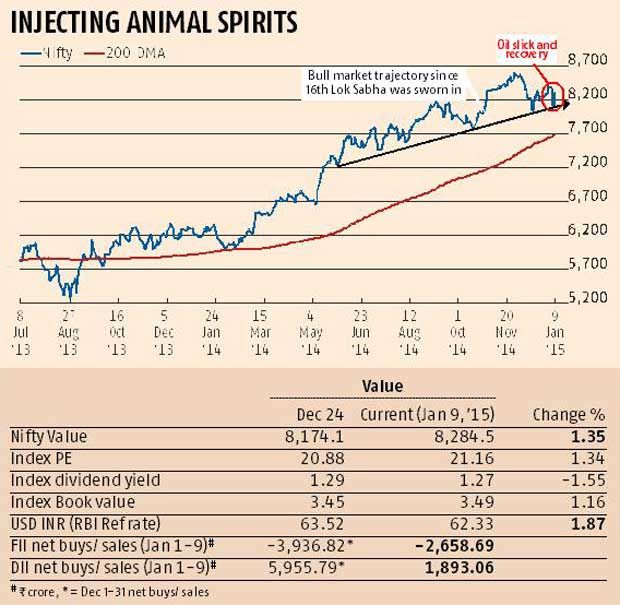

Last calendar year, foreign institutional investors (FIIs) brought in a net $16 billion to equity and $26 billion to debt.

Anecdotally, traders appear wildly over-optimistic with numbers like $30-billion net equity buying by FIIs in 2015 being bandied around. I'd be happy if the $16 billion is matched in 2015.

Most FIIs are already overweight in India.

Overall emerging market (EM) allocations and exposures are very likely to be reduced in 2015 since India is the only major EM expected to see growth acceleration in 2015. On the debt front, the limit for FII positions in government securities should be hiked.

FII buying of government securities has been consistently close to limits. There will be more interest as and when the Reserve Bank of India cuts rates.

This year is also going to see currency turmoil. The dollar has gained in secular fashion. If the US economy keeps growing at current rates, the Federal Reserve will raise rates by mid-year.

That will lead to more dollar hardening because the European Central Bank and the Bank of Japan are both aiming for respective quantitative expansions.

Both euro and yen interest rates are likely to stay near-zero. (The Swiss franc is offering nominal negative rates on some deposits).

The dollar-rupee rates have moved between 61.95 and 63.75 in the past four weeks.

The rupee has devalued 2 per cent versus the dollar in the past three months.

But it has gained in relative strength against other EM currencies. That is bad news on the export front.

At the earning level, Infosys kicked off Q3 reporting season with decent results and projections.

But most financial advisories are downbeat. Commodity inventories will be marked down in value and exporters may have been hit by cross-currency volatility.

The more pessimistic estimates even suggest earnings declines for many non-energy companies in the Sensex/ Nifty universe.

In sum, domestic investment and consumption must pick up if India is to see serious gross domestic product (GDP) and earnings acceleration in 2015-16.

Pump priming via government spending is a high-risk option since the fiscal deficit is dangerously high.

It will be interesting to see how Finance Minister Arun Jaitley tries to inject animal spirits without bloating expenditure.

© 2025

© 2025