Reflecting the mood, passenger vehicle sales in November either remained muted or skidded for most manufacturers as high fuel prices and the higher cost of borrowing dampened buying sentiment.

Automobile makers are bracing for a long winter ahead after a dull festive season, thanks to a higher interest rate on auto loan.

Sales have already slowed with vehicle financiers facing a liquidity crunch.

Reflecting the mood, passenger vehicle sales in November either remained muted or skidded for most manufacturers as high fuel prices and the higher cost of borrowing dampened buying sentiment.

Seven in every 10 passenger vehicles in India are bought on credit.

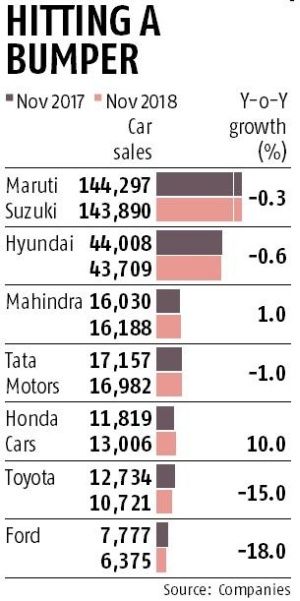

The cumulative sales of India's top seven passenger vehicle makers fell 1 per cent over the same month a year ago, showed the data released by auto companies on Saturday.

The sales of Maruti Suzuki India, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Honda Cars India, Toyota Kirloskar and Ford India stood at 250,871 units during the month, as against 253,822 units in the same month last year.

Snapping a four-month declining streak, passenger vehicles sales grew marginally on a year-on-year basis in October.

In an indication of a broad-based slowdown in one of the fastest-growing auto markets in the world, dispatches at the car market leader, Maruti Suzuki India, remained flat for the second consecutive month.

Every second passenger vehicle in India is sold by the local arm of the Japanese car maker.

The maker of the Baleno and Brezza models saw the passenger vehicle volumes slip by 0.3 per cent to 143,890 units over the year-ago period.

The contraction was led by a steep fall of 21.6 per cent in the sale of entry-level models, including the Alto and Wagon R.

With the exception of the compact car segment (the Dzire, Baleno, etc), which advanced 10 per cent over the year-ago period, all the other segments, including the utility vehicles segment, showed sluggish growth.

Hyundai Motor India, the second-largest in the pecking order, too, saw the overall dispatches shrink as compared to a year ago.

The maker of the Santro and Creta models saw its sales skid 0.6 per cent to 43,709 units.

If not for the new Santro, which accounted for 8,000 units and has received bookings of over 40,000 units since its launch on October 23, the fall could have been sharper.

Passenger vehicles sales of Tata Motors, which had been climbing steadily on the back of new model launches, came in the negative terrain and saw sales drop 1 per cent over the last year.

The Tata group flagship, however, reclaimed the No. 3 position from arch-rival Mahindra after a long hiatus.

While Tata Motors sold 16,982 units during the month, Mahindra sold 16,188 units.

Mayank Pareek, president, passenger vehicles business unit at Tata Motors, attributed the fall in sales to "strong headwinds such as liquidity crunch, higher interest rates and rising fuel costs" but expressed confidence that the launch of the Harrier, its upcoming SUV offering, will help the firm remain steadfast to its turnaround goals.

Meanwhile, the Marazzo, a seven-seater utility vehicle launched in September helped Mahindra remain in the positive terrain.

The company sold 16,188 units during the month, 1 per cent over a year ago.

"Adverse macroeconomic conditions have impacted the growth forecast for the automotive industry in general," said Rajan Wadhera, president, automotive sector, Mahindra & Mahindra. Wadhera said he expected the recent drop in oil prices and improving liquidity to drive demand.

Bucking the slowing trend, Honda Cars India saw its volume jump 10 per cent to 13,006 units over the year-ago period.

Rajesh Goel, senior VP and director, sales and marketing, attributed it to the new Amaze and good sales performance of the WR-V and City.

Sales at Toyota and Ford crimped 15 per cent and 18 per cent, respectively. N Raja, deputy managing director at Toyota, blamed the fluctuating exchange rates and higher interest rates for the tepid sales, adding that the company was keeping dispatches to dealers in check on purpose.

© 2025

© 2025