Aft India Inc is slowly putting its investment plans back on track. Data from the Centre for Monitoring Indian Economy (CMIE), a city-based research house, show “investment intentions” in 2014-15 were 80 per cent more than in 2013-14. At Rs 9.9 lakh crore, it was the highest in four financial years.

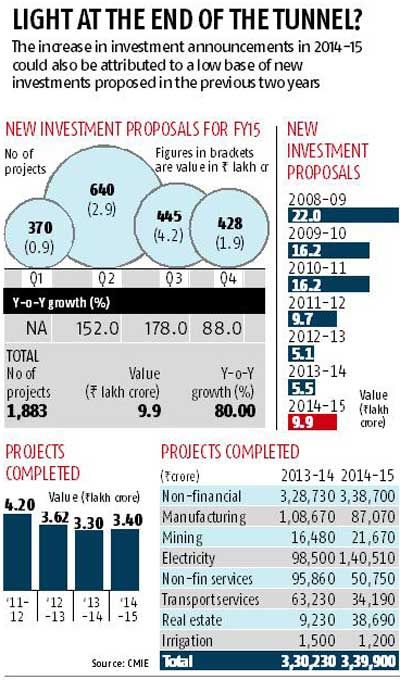

India Inc is slowly putting its investment plans back on track. Data from the Centre for Monitoring Indian Economy (CMIE), a city-based research house, show “investment intentions” in 2014-15 were 80 per cent more than in 2013-14. At Rs 9.9 lakh crore, it was the highest in four financial years.

An encouraging sign is the private sector, which was slow in announcing plans in the June quarter of 2014-15, made up for it in the subsequent quarters.

In the quarter ended March this year, its share in overall new investment announcements rose to 75 per cent from 46 per cent in the previous two quarters.

Of the 449 projects, 266 (entailing a combined investment worth Rs 1.46 lakh crore) were proposed by the private sector.

However, the sharp increase in 2014-15 might also be due to a low base of new investments proposed in the previous two years.

Mahesh Vyas, CMIE’s managing director, said, “2014-15 turned out to be slightly better than recent years.

There hasn’t been any burst of new investment activity or a spurt in the implementation of existing projects. We see a gradual and small increase in both new investment proposals and the completion of existing projects.

It is somewhat worrisome that new investment proposals during the March quarter were lower than in the preceding two quarters.”

He also sounded a word of caution on the concentration of new investments in a region. “The concentration of these new investments in Gujarat (40 per cent) implies the rest of country sees a significant slowing of investment proposals.”

During the quarter ended March this year, Gujarat was the favourite investment destination. Of the new investment announcements, 40 per cent (Rs 786 billion worth of investments) was attracted by the state alone.

During the quarter ended March this year, Gujarat was the favourite investment destination. Of the new investment announcements, 40 per cent (Rs 786 billion worth of investments) was attracted by the state alone.

The second and third preferred destinations were Karnataka and Uttar Pradesh, attracting investments worth Rs 295 billion and Rs 267 billion, respectively.

Photograph: Reuters

© 2025

© 2025