'Reserve Bank is an autonomous institution and, as governor, I am supposed to make judgments on issues in the domain of the central bank.'

'Reserve Bank is an autonomous institution and, as governor, I am supposed to make judgments on issues in the domain of the central bank.'

'The governor of the Reserve Bank is more than a regulator.'

'The government has turned to a path of fiscal consolidation.'

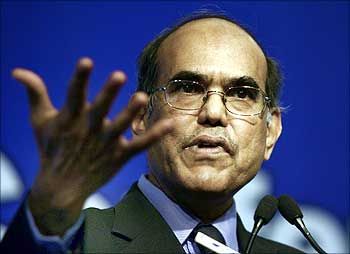

A candid account of a five-year stint as Reserve Bank of India governor by Duvvuri Subbarao, below, left, could not have come at a more opportune time, as the Narendra Modi government has to shortly take a decision on appointing Raghuram Rajan’s successor.

In conversation with Anup Roy and Abhijit Lele, the former governor talks about his memoir -- Who Moved My Interest Rate? -- and makes a strong case for a new monetary policy framework to factor in financial stability, along with growth concerns.

You have taken big names in your tell-all memoir. What made you so forthright?

I wanted to recount my experience as Reserve Bank governor.

That wouldn’t have been possible if I hadn’t taken names of individuals and ministers I had encountered in my capacity as governor.

I thought the book would add value if I plumbed the depths of detail.

How did they react when you said you’d be taking names? Were they informed early?

Except P Chidambaram, who I had requested for an endorsement, I have not shown the book to the rest.

No one has contacted me as yet after the book’s release.

I read some statements by P Chidambaram but that’s about all.

You mentioned being very careful that people not see you as an extension of the finance ministry in RBI. Were you overzealous in projecting yourself as an independent person?

I was being a professional.

I am a professional and I must act so, for the larger interest of the public.

Reserve Bank is an autonomous institution and, as governor, I am supposed to make judgments on issues in the domain of the central bank.

As a finance ministry official, you were regularly in touch with Y V Reddy and there were differences. How did the differences play out? Was it your opinion or the views of the department or institution you worked for?

The finance minister and the finance secretary take the advice of the bureaucracy to frame an opinion.

Similarly, for the governor, it’s not as if it’s his personal opinion.

It’s the policy that gets shaped by the analysis and the discussions that he has with his professional staff.

There are institutions behind both the finance ministry and the RBI governor.

How difficult was it to switch between the two?

Yes, it was difficult. Within the finance ministry and the government, you had varied objectives.

There were a large number of players, and the domain of activity was also very large.

In RBI, on the contrary, the domain is narrow and focused.

And, the deliverables are more tangible.

It was a non-trivial transition from being a bureaucrat of the finance ministry to being the governor of the central bank.

You mentioned in your memoir that a lot of measures Raghuram Rajan announced in his first day in office had already been decided between the two of you. But, you still let Rajan announce it. Since RBI is an institution, does personality matter?

To some extent personalities matter.

In times of crisis, personality takes precedence.

It was my decision.

Rajan suggested I release the policy but I thought if it was done by a new governor, especially a governor of Rajan’s calibre, it would lend greater credence.

Are you supportive of the plan to let a committee decide on a RBI governor’s appointment?

I am not supportive of a bureaucratic process for selecting the governor.

If the government appoints a search committee of experts to recommend possible candidates for governorship, I would think that would be powerful and advisable.

But, to introduce a rigid bureaucratic process for selecting the governor, is not fitting.

The governor of the Reserve Bank is more than a regulator.

He is the monetary authority.

The distinction ought to be drawn.

You are not very comfortable with a single mandate, only the inflation mandate, for the central bank.

You are not very comfortable with a single mandate, only the inflation mandate, for the central bank.

I could have avoided the chapter altogether.

But I thought I should write it because I have expressed reservations on inflation targeting and it has now become the main plank of the monetary policy framework, which would get statutory basis.

I said yes, there was a lot wrong with multiple objectives, multiple indicator approach that we were following.

But it is also not clear that we are ready to make a transition to inflation targeting.

Especially when so many other constraints inhibit monetary policy transmission.

There are difficulties for the RBI to deliver on inflation target. Short-term inflation gets influenced by shocks.

So, I had reservations about inflation targeting. But some of the factors have changed.

For example, we now have a single representative inflation index (consumer price index), which we did not have earlier.

The administered interest rate regime has been dismantled to some extent.

The small savings interest rates are now indexed, with yields of 10-year G-Secs.

The government has turned to a path of fiscal consolidation.

So, some of the factors that destabilised inflation have been addressed.

Inflation management has a chance at success under these conditions, than it did in my time.

However, inflation targeting is yet to be tested.

Should RBI have other mandates as well along with inflation targeting?

I have not studied the monetary policy framework closely enough but they have said that inflation targeting be sensitive to concerns of growth or something similar.

I think it would be advisable to have concerns of financial stability.

Top image: Reserve Bank of India. Photograph: Reuters; D Subbarao's photograph: Vijay Mathur/Reuters

© 2025

© 2025