'No finance minister has the capacity to put the economy in an ICCU just like no finance minister has the capacity to take it for 10% growth!'

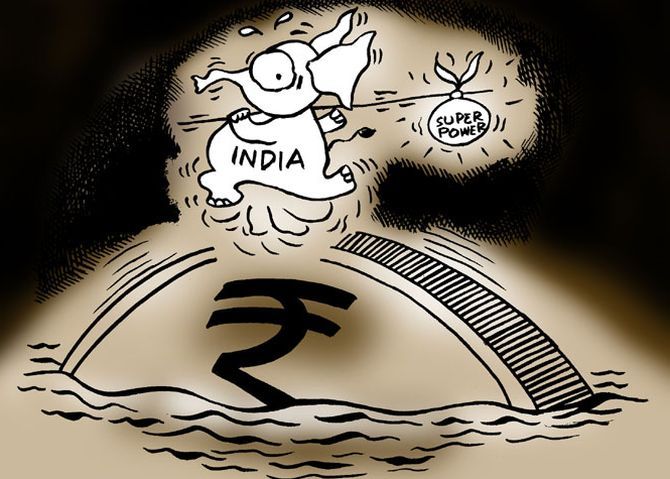

Illustration: Uttam Ghosh/Rediff.com

"This Yojana business by governments must stop," M R Venkatesh, chartered accountant and political commentator, tells Rediff.com's Shobha Warrier.

"The government must understand that the household is far more efficient and productive than any Yojana under the government," Venkatesh adds.

"To tax households excessively and shift money from households to the government must stop. The earlier Modi visits this fundamental aspect of economics," Venkatesh points out, "it will be good for the Indian economy and for him politically."

Do you think demonetisation served the purpose of bringing black money in the open?

People must understand that around 40 crore (400 million) Indians went to the banks to deposit their old currency.

Other than the physical aspect of standing in the queue and depositing the money, there is an emotional aspect to the whole exercise too.

People in general -- except for some studio warriors -- showed that they stood by the prime minister in fighting black money and gave him the thumbs up.

We must also understand that unlike an economist or a chartered accountant, people may not know black money; how we generate it, how it flows, how it is stored and how it is converted. But they know it is a complex process to cleanse the system.

The large political message is that people by and large endorsed the message and stood by the prime minister.

That was one year ago. How do you think people feel a year later?

Data suggests that less than one-and-a-half lakh (150,000) people deposited Rs 5 lakh crore in various banks.

All of them might not have had black money, all of them might not be scoundrels or tax evaders, but all of them could not be honest too.

People who had crores of rupees at home in cash owe an explanation. It is all a matter of detailing.

Notices have been given under the Income Tax Act, under the Benami Law and by the enforcement directorate. Attacks on black money by these three are going on.

The efforts will take at least 3 or 4 years to finally come with a number to show how much tax was collected.

Don't you think the public is getting restless with the pace of work and not knowing the results?

No. I would say that the studio warriors are getting perturbed and not the people.

Generally, Indians do not expect any results to come in less than 30 years! That's our mental make-up.

For us, time is limitless.

And I am not talking as a chartered accountant or a student of law, but as an average Indian. I feel Narendra Modi has scored a very big point politically.

The message he has given to the people is that a war against black money is being fought in right earnest. And that is what is making his political opponents nervous.

So, you are feel even now people trust the prime ninister...

Yes, that's why when Dr Manmohan Singh suddenly says it was organised loot and plunder, nobody is ready to believe him.

The big news was that Manmohan Singh spoke and not what he spoke!

The irony is that the man who never opened his mouth on the coal scam or the 2G scam is now calling demonetisation loot and plunder!

People also understood that there were pain points which got accentuated by GST.

Despite all these so-called economic crisis, I challenge the Communists who are holding the cudgels for the poor whether they can retain the (election) deposit in even one seat in Gujarat or Himachal Pradesh.

You must understand that here is somebody who took an effort to fight black money.

No Indian is ready to bet whether the effort will eradicate black money fully or whether it will be eradicated for times immemorial.

He only believes that black money is a monster, an asura and it should be killed. And here is someone who is waging a war against it, and people feel they must support him.

Also, the average Indian knows that you have to do your duty while the result is not in your hands. Karmanye vaadhikaraste maa phaleshu kada chana.

To this extent, the people of India feel Modi has played the role of a karmayogi and does his duty.

Having said that, some people describe demonetisation as a success while some call it a failure. I don't agree with both.

Demonetisation was originally planned in such a way that Rs 15 lakh crores of money would come into the system, which many of us did not believe, would happen.

This would have given a windfall for the RBI and the RBI would have been able to use it for many purposes including probably recapitalisation of banks.

As expected, that did not happen. If you use it as a benchmark, demonetisation was a failure.

The larger issue is that the backbone of the Hurriyat has been broken. People who were funding Hurriyat leaders using hawala channels, got into the net. That's why we have an interlocutor in Kashmir now.

Then, the activities of Naxals in many areas have come down dramatically in the last one year.

Approximately 225,000 companies were identified as shell companies, and their transactions and money laundering activities are under scrutiny. These are some of the major achievements of demonetisation.

Unfortunately, most of us would like several of these matrices to be brought down to one single number.

It was like, if Rs 15 lakh crores did not come into the system, it would be a success and if the entire Rs 15 lakh crore did, it would be a failure.

We must understand life cannot be reduced to a binary mode.

Was demonetisation a necessity like the economic reforms of 1991?

Given the circumstances and facts, it may not be absolutely necessary, but definitely one of those instrumentalities we needed to handle.

The fact is, we do not have as much data as the Government of India.

The prime minister has taken a stand which was backed by the RBI governor, his entire Cabinet and approved by the then President of India, Pranab Mukherjee. And remember he is no ordinary person.

Which do you think put a brake on the economy: Demonetisation or GST?

If you look at the data, when demonetisation happened on the 8th of November, the sowing season was in full swing in Punjab and Haryana.

After demonetisation, average sowing area went up by 5% to 6%. The farm sector was supposed to be the biggest sector hit by demonetisation, but farmers in Punjab and Haryana tided over the post-demonetisation shock quite well.

Nowhere did economic activities stop completely even in the second week of November.

Yes, there were some shocks in the SME sector and some agricultural produce could not be sold on time. This lasted only 2 to 3 weeks and things started becoming normal by January.

By June, everybody had virtually forgotten demonetisation.

Then came GST. You know my views on GST and I still hold the view that GST was a genetically flawed law.

And that (GST) created the maximum damage. Compared to demonetisation, the scale of damage is in my opinion 1:12. 1 for demonetisation and 12 for GST.

The impact of GST will be there for another 2 or 3 quarters.

And even the revenue secretary has recently come to the conclusion that GST needs a major rejig.

Many people say the Indian economy is in crisis and it has to be revived. How can it be revived?

The word 'revive' gives you the idea that the Indian economy is in ICCU. I would say the Indian economy can never go to an ICCU.

No finance minister has the capacity to put the economy in an ICCU just like no finance minister has the capacity to take it for 10% growth!

You mean the economy doesn't need a ventilator?

It is not in a ventilator and it doesn't need a ventilator.

But there is a tremendous crisis of confidence among private investors, entrepreneurs, bankers, consumers... That is because their past is catching up with them especially under the Benami law and anti-money Laundering law in case of unscrupulous borrowers.

They are not able to repay the bank and there is huge systemic pressure on them.

And since virtually the entire range of borrowers are under some scrutiny, bankers are finding it difficult to lend.

These two things are putting huge pressure on private players. These are the very people who feed the media with advertisements. That's why the media is crying that the Indian economy is in crisis and it has to be revived. That is not the truth.

Yes, there is distress and there is a lack of confidence. But it is not that the economy has completely come to a full stop.

We can easily have a higher growth rate, say from 5.7% to 8.5%. Provided we bring down taxes, reduce administrative interference, make e-governance as part of our system, ensure that banks do not come under the clutches of the CBI, CVC and the courts, have a way of systemically tackling errant borrowers and revisit the definition of NPAs.

If these are addressed pronto, I think the Indian economy will soar much higher.

More importantly, the government has to address rural stress especially by bringing in higher public investment into irrigation.

Will the RBI reducing interest rates help the Indian economy?

Interest rate reduction is like a bandage on a person suffering from Stage 4 cancer.

Also, businessmen talking about half a percent or a quarter percent interest rate reduction is comical.

0.1% reduction in the interest rate will fix the US economy, but in India, less than 2% reduction will not shake the economy.

And 2% reduction in the interest rates is not possible today.

The real solution for India is to make it (the economy) more efficient. For that, our tax-GDP ratio has to come down.

Contrary to the popular opinion we are taxed excessively for services the government gives us. So, bring down taxes and put the money in the hands of housewives and let her manage the household.

Why do you want to put money in the hands of the government?

Fundamentally, one rupee in the hands of a private individual is far better spent than one rupee in the hands of the government.

For this to happen, they have to bring down taxes and cut down government expenditure totally.

Unless this is done, we will be taking money from the most productive sector -- namely the household sector -- to the most unproductive sector, which is the government sector, under some Yojana.

This Yojana business by governments must stop.

The government must understand that the household is far more efficient and productive than any Yojana under the government.

To tax households excessively and shift money from households to the government must stop.

The earlier Modi visits this fundamental aspect of economics, it will be good for the Indian economy and for him politically.

© 2025

© 2025