'One has to file not less than 37 returns per year for every ordinary business, and that too per state.'

'If you are doing businesses in Chennai, Bangalore and Hyderabad, you have to file 37x3 returns every year!'

'The consequence of GST will be chaos, confusion and possibly economic crisis.'

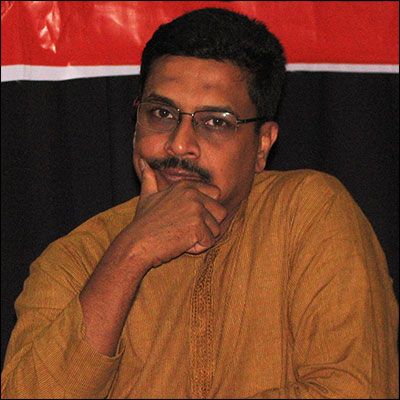

Illustration: Uttam Ghosh/Rediff.com

Despite his endorsement of the Narendra Modi government, M R Venkatesh, a chartered accountant and political analyst, is a vehement critic of the Goods and Sevices Tax.

In earlier interviews, he had said that 'our economic niravana is not through GST' and warned that post GST consumers will pay more.

"When the government was supposed to create a majestic animal called the elephant," Venkatesh, bottom, left, memorably says, "they decided to have the body of an elephant with the tail of a goat, the hump of the camel, one leg of a jackal, one head of a mouse and the intestine of a python."

Now that the Modi Sarkar is all set to roll out the GST on the midnight of June 30, 2017, MRV -- as he is popularly known -- shares his thoughts about India's 'biggest tax reform' and what awaits the country in the next two years with Rediff.com's Shobha Warrier.

From the prime minister to Commerce and Industry Minister Nirmala Seetharaman, the Bharatiya Janata Party government is talking about GST as if India is set to achieve economic niravana from the midnight of June 30.

Do you still maintain that we are not going to achieve any such thing?

Nirvana has dual connotations -- spiritual as well as physical; when one is stripped completely.

I do not know which nirvana you are talking about -- spiritual or physical.

Do you still feel it is going to be a self-goal by the BJP?

I pray that it is not a self-goal, but the chartered accountant in me says it is a self-goal for all businesses -- from large, medium to small.

If my understanding is correct, one has to file not less than 37 returns per year for every ordinary business, and that too per state.

If you are doing businesses in Chennai, Bangalore and Hyderabad, you have to file 37x3 returns every year!

The problem is, if something goes wrong, the GST assumes that it is a wilful default.

So, my worry is people can be held ransom for even a simple mistake, by the revenue department.

If the clerk in any organisation makes some mistake while uploading the information, the owner will be held responsible, and believe me the consequences are draconian.

And that in my opinion, will breed corruption.

Alternatively, every businessman will be expected to pass the agni pariksha of the tax administrator and then only s/he will be declared clean.

So my worry is, in the first two years, there is going to be huge number of mistakes out of misunderstanding or lack of understanding.

The consequence will be chaos, confusion and possibly economic crisis.

Most citizens who do not understand the intricacies of GST are confused. Small businessmen and shopkeepers are confused.

The government claimed that GST means one nation, one tax, but now, they are saying that there are four different tax rates.

How exactly does GST work?

One nation, one tax has finally ended up as one hotel and three taxes!

Even for a restaurant, there are three tax slabs -- ones with AC have one rate, without AC have another rate, and the third one for smaller restaurants.

All this will result in utter chaos.

It is not just four rates; you have eight rates of taxes.

And multiple rates will be an incentive for evasion.

And since the law and the rate encourages evasion, the revenue department will suspect every assessee.

From now on, it is a proverbial case of downward spiral -- a race to the bottom.

To understand where GST went wrong, I have to quote a Tamil proverb, Pullayar pudika poi korangu anathu.

If you go to any temple here, you will see that Lord Ganesha -- Pullayar -- who will invariably be opposite Lord Hanuman.

This is what has happened to GST.

The original GST is 180 degrees at variance with the GST we have got now.

The basis of GST is the Kelkar committee report of 2003.

He wanted one tax from Kanyakumari to Kashmir and Kandla to Kohima, which meant that the states and Union Territories exist for every administrative purposes, but do not have the right to levy any indirect tax.

Kelkar called it a 'Grand Bargain'.

Our politicians realised that if they brought in such a law, it would go against the basic structure of our Constitution.

Our policy framers realised far too late in the day that we could not deny the states of their taxation power without altering the basic structure of our Constitution, which is impossible.

So what came about is a 'grand compromise of sorts' between the Centre and the states, but without the promised 'grand bargain'.

And whenever there is compromise, there is bound to be pitfalls.

And whenever there is compromise, there is bound to be pitfalls.

So, when they were supposed to create a majestic animal called the elephant, they decided to have the body of an elephant with the tail of a goat, the hump of the camel, one leg of a jackal, one head of a mouse and the intestine of a python.

This is what we have got as the GST!

Naturally, it is not just ordinary citizens like you, nobody is able to understand what type of an animal this GST is.

They said this would be a very easy tax to administer, but the Institute of Chartered Accountants of India are conducting seminars after seminars to explain the GST, but after each seminar, chartered accountants are more confused than they were before the seminar started.

It is not only the rates, but the very DNA of the GST is flawed.

Unless the states gave up the right to tax, GST was impossible.

What we have got is a spurious GST.

The prime minister said tax terrorism would end with the GST, but it appears what we are going to experience is something bigger than terrorism...

It is going to be tax jihadism. Terrorism is a mild word.

I would say lawyers and chartered accountants are going to benefit and society is going to suffer.

The prime minister told CEOs in the US that GST would be a game changer and they should come and invest in India...

I wish the prime minister was briefed properly on this.

I sincerely hope what he says comes true, but having known the tax administrators in the last 25 years as a practicing chartered accountant, all I can say is that the propensity of our bureaucracy is not to say, 2+2 as 4, but √16.

On top of this convoluted law and a bureaucracy that is behind the curve, we have a judiciary that will also find it difficult to cope with the new law.

This situation could even lead to multiple problems.

We are in for chaos.

The data that appears in the newspapers say citizens are going to pay more for things like tea, coffee, TVs, fridges, computers, AC travel in trains, air travel and even service tax.

So, other than the confusion, chaos and cluelessness, are consumers going to pay more post-GST?

Exactly. Today, I saw an ad in the paper that says the prices of TVs, fridges, etc are going to increase post-GST, so buy before June 30.

On the other page, there was Amitabh Bachchan telling us GST is a boon.

These are the two totally contradictory ads in the papers.

I am not sure what it will be for the consumers. We have to wait and see. But I am not very hopeful of a price reduction.

Another cause for worry is the anti-profiteering clause that says dealers and manufacturers should not take profit out of GST.

The rules are so complicated that it can lead to corruption.

Importantly, it shows that the mandarins of North Block still do not believe in the market, they believe in administered prices.

They think they can micro analyse the books of every businesses.

Likewise, there are provisions on search, seizure, raid, inspection, and survey in this law despite providing so much of information.

All this indicate a lack of faith in the system by the law makers.

I would call this mindset, unadulterated jihadism.

The middle class have been supporters of the BJP. If this is going to affect them badly, won't it affect the BJP politically?

I don't want to look at this from a BJP or a Congress angle because even the Left supported the GST.

Yes, if GST fails, probably the price will have to be paid by the BJP politically.

But I am looking at it from the national position.

I feel the political parties should have the courage to alter the basic structure of the Constitution and say that the states should not tax.

I may sound a bit outlandish, but if you want to have one nation, one tax, you have to do this.

One nation, one tax does not mean 29 states and 29 laws for each states with several rate of taxes.

We have 36 GST laws now at the state and UT level which replaced 36 VAT laws.

Then we had one central sales tax which has been replaced by IGST.

And instead of excise and service laws, we have one GST.

So, under the GST regime, we have 38 laws instead of 39 laws under the present regime!

Last year, many people were telling us that GST will bring in 2 per cent growth, additional revenue for the government, it will be anti-inflationary and it will protect the dealers' margin.

Mathematically, how is this possible?

Two out of the above four is possible, but 4 out of 4 is a mathematical impossibility.

Businessmen think they will get more money.

The consumer thinks it will be anti-inflationary.

The government hopes to get more revenue.

Economists think there will be 2 per cent growth.

As a student of economics, I know this is impossible.

Do you think the consumer will be the loser ultimately?

One cannot generalise. It will be a case where some consumers will lose and some gain, but prices will never come down, that's for sure.

In India, I have not seen a single instance of a single excise cut being passed on to consumers in the last 25 years.

Some experts also feel that GST may slow down the economy further.

My worry is, as development is rooted in confidence, if you are not confident of success, you will not invest.

In this type of a diffused scenario where you are uncertain about the effects of the GST, you will decide to wait for one or two years till everything settles down before you invest.

The backbone of the Indian economy is the SME sector and if you load them with this kind of a draconian law, they will not be able to stand up.

You cannot treat a multinational company and a small business on par.

So, because of the confusion and lack of clarity, there will be a slowdown.

What do you foresee politically and economically for India?

If it is successful, there will be many parties and people, from (Palaniappan) Chidambaram to Manmohan Singh to Ashok Mitra to Mamata Banerjee to claim credit, but if it fails, unfortunately the axe will fall only on the prime minister.

Strategically, the BJP should not have showcased the GST as a priority.

In my opinion, the reputation of the prime minister is not worth the political risk taken.

As far as economic growth is concerned, the investment cycle that is already in a dip, will remain so because of the confusion.

Nobody will start a new factory or a venture soon.

Everybody will be on a wait and watch mode.

Also, GST will push us down further in the ease of doing business.

Ultimately, there will be chaos, confusion and possibly crisis.

Why is the government projecting GST implementation as another tryst with destiny?

I don't know. But I know that traditionally this land has not believed in doing anything auspicious at midnight.

We consider early morning as Brahma Muhurtham like Professor Vaidyanathan (of the Indian Institute of Management-Bangalore) says, 'You cannot wake up God in the middle of the night and say, I am bringing in GST, so kindly bless me!'

On a serious note, this is because of our obsession with the Moodys and the S&Ps and their rating.

Our concern is not the tax payee or the assesse; our concern is some rating agency sitting 6,000 miles away.

Why are we bothered so much about their ratings?

Only if you are obsessed with what London and New York say, you will indulge in this kind of a tamasha.

© 2025

© 2025