'When there is no middle ground possible between the government and the governor, the governor has to go.'

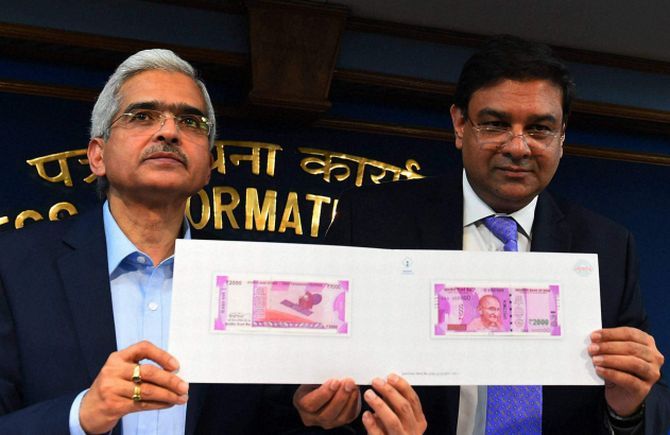

Dr Urjit Patel's sudden resignation as Reserve Bank of India governor, citing personal reasons, has stunned financial policy circles and the layperson alike.

Dr Patel's predecessor, Dr Raghuram Rajan, perhaps summed it best when he said, 'This is something that all Indians should be concerned about because the strength of our institutions is really important for our growth, sustainable growth and equity in the economy.'

T C A Srinivasa Raghavan, author of Dialogue of the Deaf: The Government and the RBI, below, tells Rediff.com's Shobha Warrier that Dr Patel's resignation will not have any impact on the Indian economy.

Some say Urjit Patel's resignation is a big blow to the government while others feel it is no a calamity. What do you say?

It is neither a big blow nor a calamity; it is somewhere in between.

Yes, it will cause a little disturbance, but I feel after two, three days, it won't matter because in the overall scheme of things, the RBI governor is important but not a very high functionary of the government.

Governors come and governors go. But the manner in which all this has happened is very nasty.

My personal view is that Urjit Patel should not have resigned; he should have stayed on and completed his term. This is not the way important functionaries of the government should behave.

Do you think the problem started after Swaminathan Gurumurthy was inducted into the RBI board?

I don't think you can ascribe this to one person. Gurumurthy's way of articulation and what the government wants may not be to Urjit Patel's liking, but you have to look at the substantive argument and see what Gurumurthy or anybody else representing the government or what the government was asking the RBI to do. You have to judge it on merits.

The fact of the matter is that all governments need money.

There was a time when the Reserve Bank would help by printing notes. That stopped in 1998. Since then, whenever the government wanted money, it could do it by taxing more. Now with GST, that option is gone.

What will the government do if it needs money?

You have to look for ways by which the RBI and the government can co-operate.

Ultimately, there is no escape from printing more notes in a very tight situation when the government needs money.

You can argue whether we are in a tight situation now or not. Suppose we come to a conclusion that we are in a tight situation, the RBI cannot say that it will not print notes.

Assuming that the RBI says it will not print notes, what will the government do?

This is a problem, I am sure Urjit Patel understood, but he was quite rigid about the RBI's independence.

The fact is the original RBI Act does not allow for any such behaviour. Whatever independence the RBI has, it is what the government grants it.

This is what (former RBI governor Dr) Y V Reddy said, 'I am as independent as the government allows me to be.'

Some governments allow you to be very independent and some do not, but you can't claim it as a right under the present law. If you want to be independent, you have to change the law.

The criticism is that the RBI is losing its autonomy because of pressure from the government...

The pressure has always been there; from the time the RBI was started in 1935. This is nothing new and there is nothing you can do about it.

Is the government right in using Section 7 of the RBI Act (which empowers the government to issue directives to the RBI)?

It is there in the law and the government can use Section 7. If you don't like certain things, you must change the law. As long as the law is there, you have to do what you are told to do.

Do you feel it was more an ego clash than anything else?

Very much.

The RBI has a lot of reserves with it and the government is asking for money from the reserves to fix the economy. Is there anything wrong in asking for money from the reserves?

There is nothing wrong in asking for it. And it is not the first time this is happening. This began in 1986. Yes, you can have some of the reserves, but the question is, how much?

How much reserves should the RBI keep?

(Former chief economic advisor) Arvind Subramanian says there is too much reserves. Some say, it is too little. Who is to decide what is too much and what is too little? We don't know the answer. This is something you should sit and discuss and not just quit.

When the economy needs money, shouldn't the RBI be using it to help the economy? After all, the money has to be used for the country.

Reserves are kept like you keep money for a rainy day. Suppose all the public sector banks were to collapse, and they needed to be recapitalised, this has to be used.

This money is actually kept to recapitalise banks. So, there is a problem when the RBI says we won't give it for that too.

I think this has to be decided through discussion and not by quitting.

Did all the problems not start with the mounting NPAs in the public sector banks which started during the UPA period? Is this not an inherited problem?

Did all the problems not start with the mounting NPAs in the public sector banks which started during the UPA period? Is this not an inherited problem?

Yes, it is an inherited problem. These are all very delicate matters which have to be dealt with systematically in a nuanced fashion. You can't deal with it with a heavy dose of antibiotics.

What is the use if you kill the patient after the operation?

Yes, the NPA problem started with the UPA government. Now, they have put in place a mechanism to deal with it and Urjit Patel agrees with that mechanism.

The government also agrees with the mechanism. The question is: How do you use it? Do you use it at one go or gradually?

For example, do you want all these power companies to close down because they are bankrupt? Suppose you have a problem with your fist, do you cut off your whole hand?

You can come to a decision only through discussion. The government has been discussing it from February.

I think Dr Patel must have been a little bit rigid. Or the government must have been asking a little too much.

When there is no middle ground possible between the government and the governor, the governor has to go.

Can an RBI governor, appointed by the government, be so rigid to the demands of the government?

No, he can't. You can, but then you run the risk of being sacked. He is not the first governor who left. There were four governors before him who were asked to go.

MSMEs suffered a lot due to demonetisation. Is it wrong to lend money to these MSMEs and help them stand again?

In the case of MSMEs, the RBI was very co-operative. But where is the money to lend? That is the problem. The RBI has opened a Rs 25 crore window.

You have to print notes as we don't have no money. Whether it comes from this window or that window, it is irrelevant.

Suppose the government says they need Rs 2.1 lakh crore extra money this year, the RBI should print those notes and give to the government. The RBI has to do it.

It will cause some inflation, but it will increase the output and productivity.

The fact is it is a very delicate situation and it cannot be dealt with in this manner.

Will the RBI governor resigning have a negative impact on the economy? Will it be back to normal after the government appoints another person in his place?

Absolutely. When a driver goes, the car may not run for two or three days, but after that when you appoint a new driver, the car starts moving.

The criticism will be the government has appointed a governor who listens to it...

Tell me, which governor has not been?

Except for Raghuram Rajan and Urjit Patel who have had problems, can you show one governor in the list of 14 or 15 who did not do what the government wanted them to do? Not one.

Are RBI governors supposed to listen to the government? Or are they supposed to be independent?

They are supposed to talk and solve the problems. Usually the problem is not over what is to be done; it is over how it is to be done and how quickly it is to be done.

Will Urjit Patel's resignation be a big problem for the government or the Indian economy?

No. There is already a problem with the economy and the resignation is not going to make much of a difference.

Suppose you are running an MSME, what has the RBI governor got to do with what you need?

What has happened is a good headline for discussion, that's all.

You mean, life goes on...

Yes, life goes on.

When you are ill and admitted in a hospital, do you care who the medical superintendent is? You only want to know who your attending doctor is.

Similarly, if you are an MSME and your local bank is co-operative, you don't care who the RBI governor is.

I think this resignation is hyped up too much.

© 2025

© 2025