While naysayers say the economy is on a downward spiral, optimists point out that India has experienced a shift of gears in the realm of policies, thanks to several initiatives of the Narendra Modi government, says Ashok K Lahiri.

Depending on what you read and who you listen to, you may conclude that the Indian economy is in a crisis, or is turning around.

Of course, Marxists, for well over a century, have seen a “crisis” coming in every capitalist system.

But, “crisis” proponents in India, “Despondents” henceforth, are not restricted to Marxists alone.

Titles such as “India’s imminent economic crisis” appear even in mainstream newspapers.

A month ago, Yashwant Sinha, a former finance minister of the ruling party, described the economy on a downward spiral, heading for a hard landing.

Despondents point out that the economy has lost steam since the first quarter (Q1) of 2016.

Since then, from 8.7 per cent, growth has decelerated to 5.7 per cent in Q2 of 2017.

The Labour Bureau’s figures show unemployment up from 3.8 per cent in 2011-12 to 5.0 per cent in 2015-16.

Between 2015-16 and 2016-17, growth in manufacturing declined from 10.8 per cent to 7.9 per cent, and in construction from 5.0 per cent to 1.7 per cent.

Many projects, particularly in infrastructure, are stalled. The value of stalled projects rose from Rs 10.7 trillion in September 2016 to Rs 13.2 trillion in September 2017.

Between 2011-12 and 2016-17, as a proportion of gross domestic product (GDP), gross fixed capital formation fell from 42 per cent to 38.4 per cent.

Growth in bank credit slowed down from 10.9 per cent in 2015-16 to 8.1 per cent in 2016-17.

The overall gross non-performing assets (NPA) of banks, as proportion of their gross advances, have almost quadrupled from 2.5 per cent in March 2011 to 9.6 per cent in March 2017.

Demonetisation of the old Rs 500 and Rs 1,000 notes on November 8, 2016, has disrupted economic activity, particularly in the informal sector.

The Goods and Service Tax (GST) from July 1, 2017, has added a further disruption, particularly for small and medium businesses.

The unwillingness of the government to impart a fiscal stimulus by departing from the Fiscal Responsibility and Budget Management Act (FRBMA), and the stubbornness of the Reserve Bank of India (RBI) in not reducing the policy rate sufficiently are compounding an already difficult situation, the Despondents argue.

Now, let us turn to the “Optimists” who see the economy turning the corner.

Not only the RBI, but external agencies such as the International Monetary Fund and Asian Development Bank are projecting the economy to grow between 6.7–7.4 per cent in 2017-18.

Perseverance with the FRBMA, together with the RBI’s inflation-targeting monetary policy framework from August 2015, has resulted in macroeconomic stability.

Inflation has steadily declined from a high of 11.5 per cent in November 2013 to 3.3 per cent in September 2017, and the current account deficit has shrunk from a high of 5.2 per cent of gross value added (GVA) in 2012-13 to 0.8 per cent in 2016-17.

Dollar value of exports has increased by 25.7 per cent in September 2017.

The Index of Industrial Production (IIP) for August 2017 shows not only a recovery of growth to 4.3 per cent, the highest since November 2016, but also an expansion of production of capital goods by 5.9 per cent.

According to the BSE-CMIE surveys, unemployment is on a downward trend from 9.82 per cent in August 2016 to 4.47 per cent in September 2017, the Optimists point out.

Stalled projects is a source of concern, but the stalling rate in government projects has declined from a high of 9 per cent in December 2015 to 7.3 per cent in September 2017.

Cost and time overruns in central-sector infrastructure projects are down sharply, indicating better implementation and more efficient public expenditure management.

Sluggish growth in bank credit partly reflects the growing recourse of listed companies to non-bank credit, such as overseas funds, ECBs, institutional borrowing, and mutual funds.

The Optimists point out that the government, on October 24, 2017, announced a Rs 2.11 trillion ($32.43 billion) recapitalisation plan for public sector banks.

Recapitalisation along with the newly enacted Insolvency and Bankruptcy Code, 2016, and growth should resolve the twin balance sheet problem involving banks saddled with NPA, and borrower firms under heavy debt burden.

Beyond the maze of numbers, at a more fundamental level, Optimists, including myself, will argue that India has experienced a shift of gears in the realm of policies.

Abolition of the Planning Commission from August 2014 signalled the formal end of socialist planning with its permit-quota-licence raj.

The move is from populist policies and a marked democratic “deficit bias” to a set of policies for sustained growth.

There are fewer promises of gain without pain, removing poverty “now and here” and increasing deficit-financed public expenditure to benefit specific groups.

After the inevitable pain from destabilising the status quo through robust reforms, dividends are bound to follow.

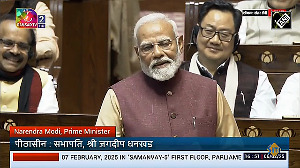

Over and above those for macroeconomic stability, several initiatives of the National Democratic Alliance government led by Prime Minister Narendra Modi, provide clues to the shift in policies.

First, in spite of its anticipated short-term disruptive impact, the long-pending GST was finally launched in July.

GST has brought goods and services at par in taxation, consolidated 17 central and state taxes under it, facilitated inter-state commerce to unify India into one market and removed difficulties in levying appropriate countervailing duties on imports.

Second, with Benami Transactions (Prohibition) Amended Act, 2016 and Undisclosed Foreign Income and Assets (Imposition of Tax) Act, 2015, there is emphasis on removal of corruption.

The demonetisation last November was indeed disruptive, but it is too early to conclude what the government will do with the knowledge of who deposited how much, and what effect it will have on generation of black money in the future.

Third, like under the Atal Bihari Vajpayee-led NDA government, infrastructure has received a big push. Recently, Rs 6.92 lakh crore was approved for building 83,677-km of roads over five years.

Fourth, with liberalisation, especially after the Make in India initiative, of foreign direct investment (FDI), such inflows have gone up from $28.2 billion in 2013 to over $44 billion in each of the two years 2015 and 2016.

Fifth, the Direct Benefit Transfer scheme came under the preceding UPA government, but too late in January 2013 and too small a scale.

By linking the Jan Dhan accounts, Aadhaar cards and mobile phones, the NDA government has scaled up a strengthened version from August 2014.

Benefits from more efficient disbursements of welfare payments to the beneficiaries’ bank accounts, and less leakage, have already started to accrue.

Photograph: Amit Dave/Reuters.

Ashok K Lahiri is an economist.

© 2025

© 2025