The GST has been a great achievement, but it does suffer from weaknesses, says Chief Economic Adviser Arvind Subramanian.

Illustrations: Dominic Xavier/Rediff.com

After the constitutional amendment bill that midwifed it, and with the passage of the four laws that have given it elaborate flesh and substance, the Goods and Services Tax has entered its last and critical phase: the determination of the GST’s rate structure.

Late last year, there was agreement on five broad GST slabs: 0 (the exempted category), 5, 12, 18, and 28 per cent; there was also agreement that cesses -- to finance possible compensation to the states -- would be levied on certain demerit goods (tobacco and related products, aerated beverages, luxury cars, etc).

Now is the moment of truth when items will be assigned to the different GST slabs and the exact amounts of the cesses will be decided.

The actual rate structure has already become overly complicated. Now, it is time for damage limitation.

I discuss below some key issues with recommendations on the desirable course of action.

A few general points must be highlighted at the outset.

This is a constitutional moment for the GST, a moment ripe for ambition and visionary decision-making which must be seized because it comes ‘but rarely in history’.

Inevitably, in the future, inertia, ‘dead habits’, and the unavoidable diversity of interests will reassert themselves, strongly perpetuating the status quo.

So, the rate structure decided today is likely to persist for considerable time.

In that light, the guiding principle cannot be to minimise departures from the status quo. If that were the case -- and if, hence, GST rates were set close to today’s rates -- the question might legitimately be asked: why bother with a GST at all?

Instead, the guiding principle must be: what will make for a good GST, a GST that will facilitate compliance, minimise inflationary pressures, be a buoyant source of revenue and command support from the public at large.

It is essential not to saddle the GST with multiple objectives; down that path lies complexity and arbitrariness that will be fatal for the GST.

The GST is a consumption tax, so any differentiation of rates -- which in any case should be minimal -- should be linked to protecting the consumption basket of the poor while imposing a greater burden when there are externalities associated with consumption or where consumption is disproportionately by the rich.

The GST cannot be burdened with the task of meeting other objectives such as employment, industrial policy, and social engineering.

Another general point, and one that will pose a communication challenge is this: today’s headline tax rate is not the actual tax burden felt by the consumer. What you see is NOT what consumers get.

So, if the government imposes a GST rate that seems greater than today’s rate (excise plus VAT combined), it does not necessarily follow that the tax burden has gone up.

The reason is that, today, there are a lot of embedded taxes (the so-called cascading).

Under the GST, on the other hand, what you see will be close to what consumers get. So, if a product goes from being exempted today and attracts a GST rate of 5 per cent, it could well be (as in the case of many agricultural products) that there has been no increase in the consumer’s actual tax burden.

Tax Structure

Under the proposed rate structure, India will be seen, rightly, as a very high GST country because the top rate has been set at 28 per cent, well in excess of that in most emerging market countries.

There is still time to consider eliminating the 28 per cent rate and creating a combined rate of say 20 per cent, which would then be, and be perceived as, the standard rate.,

However, if this is not feasible and the 18 and 28 per cent slabs are here to stay, a second-best must be considered.

In order to credibly signal an 18 per cent GST rather than 28 per cent GST, the number of goods that are placed in the 28 per cent slab must be kept at an absolute minimum.

In my view, the 28 per cent slab should include only the demerit goods (no services) on which additional cesses will be levied and a few real luxury items such as air-conditioners and cars.

The bulk of consumer goods that are currently envisaged to be in the 28 per cent category should be moved to the 18 per cent category.

Otherwise, India will be a high GST country and there will be no escaping that stigma and all the consequences for tax administration and compliance that will follow from it.

As a rough rule of thumb, if the 28 per cent slab contains items that comprise more than say 5-7 per cent of the value of all GST taxable products, India will be seen as a high tax country.

If there is a risk of too many goods being put in the 28 per cent category, there is now subtle pressure from the states (which have been guaranteed a minimum growth of 14 per cent in revenues associated with GST-able goods) for placing many goods and services in the lower rate slabs of 5 per cent and 12 per cent.

This too must be resisted because the more the goods in the lower rate slab, the greater will be the pressure to overload the 28 per cent slab.

The result will be a populist GST where several goods and services are placed in the low rate categories; then revenue considerations and populism will force lots of goods also being placed in the 28 per cent category.

One bargaining chip that the Centre could consider is to lower the compensation threshold (from say 14 per cent to 12 per cent) if states insist on placing goods in the lower rate slabs.

‘GoodsandServices’, not ‘Goods and Services’ and certainly not ‘Many goods, many services’

One of the big virtues of a simple GST with one or at most two rates was that it would have abolished completely the distinction between goods and services (it would have been a lexicographer’s dream and a GST bequest if a new word ‘goodsandservices’ could have been created).

Technology and the modern economy are blurring the distinction between the two. Our tax policy and system must reflect that.

Tax authorities should not be burdened with distinguishing a good from a service. (A single rate will also avoid misclassification between services.)

Given the rate structure that has been adopted that is going to be difficult to achieve.

But damage limitation will require that an overwhelming majority of the goods be taxed at the standard rate of 18 per cent, and nearly all services (with the exception of road transport) also be taxed at 18 per cent.

If services are also allocated between the different rates, the result will be a messy system with multiple categories for both goods and services.

Consider the following example.

Suppose a dealer sells an air-conditioner and also provides installation and other post-sales services.

Under the proposed GST structure, a rate of 28 per cent will apply to the former and 18 per cent to the latter. This immediately creates an incentive for the dealer to allocate the costs of the air-conditioner towards the services that he is providing.

Examples like this abound in real life (downloading of software = service; sale of that same software in a physical medium = good, possibly).

In fact, it could get worse: if the dealer is deemed to be providing a composite supply, even the services he provides could be taxed at 28 per cent.

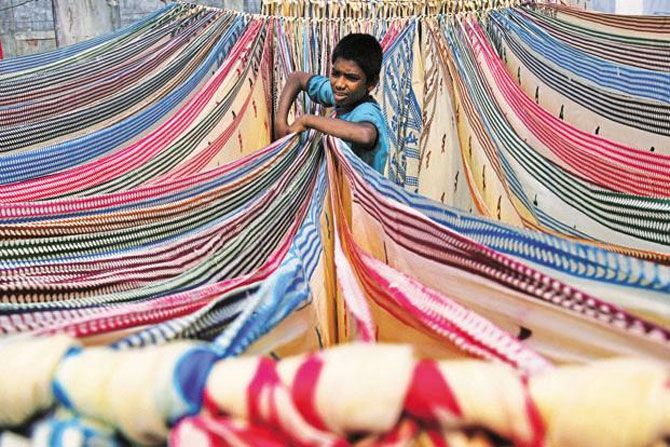

Textiles and Clothing

The current system of indirect taxation is a mess of exemptions and complications.

If India is to become a serious clothing exporter -- especially in the dynamic man-made fibre segment -- the GST must provide for a simple structure.

Ideally, all textiles and clothing products should be subject to the standard 18 per cent tax with no favouritism displayed toward cotton-based products (consumed mostly by the rich) over those based on man-made fibres.

As a second-best, it may be necessary to move to a 12 per cent rate, but that should be applied uniformly across the entire value chain -- from raw materials to intermediates to final goods.

Any differentiation within the sector would be very damaging.

The same applies to leather and footwear.

Since these are items of general high-end consumption, there is no reason to tax all these products at anything other than the standard rate of 18 per cent.

Gold

In the 2016 Budget, a 1 per cent excise was levied on gold and jewellery products which elicited strong reactions from the gold trading lobby. The government, to its credit, resisted demands to roll back that 1 percent levy.

Having bitten that bullet, it is time to take the next step to treat gold like any other item of luxury consumption.

Ideally, of course, the tax on gold and jewellery should be the normal 18 per cent especially since the rich and very rich consume it disproportionately.

But the argument that high tax can lead to evasion has some merit in the case of a high value product such as gold.

Today, even though the total headline tax on jewellery is 2 per cent (1 by the Centre and 1 by the states), the effective burden faced by consumers is about 10-12 per cent because of cascading and non-availability of input tax credits.

So there would be no increase in burden if the GST rate is set at 12 per cent (with free flow on input tax credits).

It would be an absolute travesty if gold and gold products were taxed at anything below a GST rate of 12 per cent.

Tobacco products

Today most tobacco products are taxed at very high rates reflecting their potential to cause cancer and other diseases; they are a classic demerit good.

Bidis, on the other hand, attract very low taxes in some states on the grounds that they are made in the small-scale sector and offer a livelihood to millions.

This is a classic case of multiple objectives leading to distortionary taxation.

In consumption, bidis are no less harmful than cigarettes. So, the GST as a consumption tax should treat the two similarly.

The objective of helping bidi workers should be addressed through other fiscal tools such as subsidies (in any case, small bidi establishments will fall below the GST threshold).

In the new regime, therefore, the cess on all tobacco products should be broadly similar.

In fact, bidi taxation is going to be a test for the GST Council because there are some states such as Karnataka and Rajasthan that tax bidis heavily.

Since taxes have to be uniform across states, it will be interesting to see if the GST lurches towards the undesirably low levels, as in West Bengal, or moves to the desirably higher levels, as in Karnataka.

Countervailing duty and special additional duty exemptions

Currently, numerous exemptions are granted on CVD and SAD levied on imports which favour imports over domestic production. Under the GST, both will be combined and a uniform IGST will be applied on imports.

If any import IGST exemptions are allowed under the GST (to mimic the current CVD and SAD exemptions), that would make a mockery of the PM’s Make in India initiative.

In conclusion, it must be accepted that the GST suffers from weaknesses largely related to the exemption of so many items from its scope: alcohol, petroleum, electricity, land and real estate, health and education.

But warts and all, the GST has been a great achievement and worth having not least because of being a daring experiment in the governance of cooperative federalism. It would be curmudgeonly not to acknowledge this first-order fact.

In order to minimise the damage from these warts, at least the structure of rates on those products not excluded should be low, simple, and efficient.

In politics, it is asserted, and rightly so, that the best should not become the enemy of the good.

At the same time, politics must yield outcomes that are passably good otherwise they are not worth having.

Can the GST Council, at this constitutional moment, deliver such an outcome?

The country will be watching, oscillating between hope and anxiety.

Arvind Subramanian is chief economic adviser in the ministry of finance. The views are his own.

© 2025

© 2025