How sustainable and prudent is the policy of boosting services without commensurate growth in infrastructure in the relevant sectors, asksA K Bhattacharya.

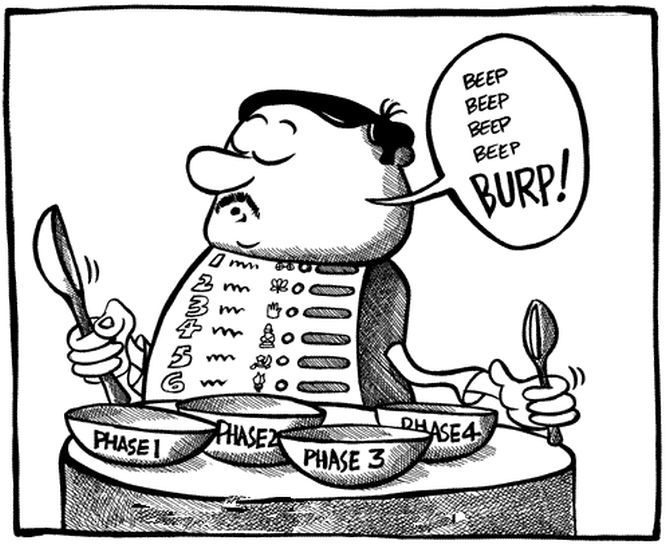

Illustration: Uttam Ghosh/Rediff.com

Recent newspaper reports have drawn attention to an interesting trend in investment flows in certain sectors of the Indian economy.

Investors’ interest in ventures that offer online food delivery services has been on the rise. That is not all.

The value of investment committed to such ventures is now reported to be close to what the restaurant sector has obtained in a similar period of time.

This may augur well for the online food delivery industry. But taken together with the relatively slow pace of investment in the restaurant segment, this may also be construed as an alarm bell for the entire food industry.

Investment in online food services may help gainfully connect the consumers of food with those who produce it, but the investment trends in both the food service providers and the sector that produces the food need closer study.

It is possible to argue that these are early trends in a relatively new industry and the healthy pace of investment in the food services sector may well be the result of a gap that arose with the advent of technology.

Until a few years ago, there was no scope for an online service to connect restaurants with consumers.

Things have changed and changed so rapidly that consumers now prefer to tap online food service providers to check out various options and then place orders.

Hence, there is a gap that needs to be met and the relatively slower pace of investment in the restaurant sector may well be a reflection of the catch-up efforts in evidence in online food services.

Yet, it would be imprudent not to recognise that the investment pace in the sector producing food should not ideally be lower than that in the segment engaged in online provision of food services.

If investments in the restaurant sector do not grow rapidly enough, it is likely that the online food service providers will suffer with consequent loss of options for the end-consumers of food.

In other words, you may see mushrooming growth in the number as well as the size of online food service providers.

But what will they serve or what will they connect the consumers with, if there is no commensurate growth in the restaurant industry?

The physical aspects of the food industry, represented by restaurants, must keep pace with online food services.

The bricks must grow as fast as the clicks. Any dichotomy or discrepancy in the growth and spread of the two is not a healthy trend.

The bigger fear is that such a trend may already have spread to other sectors of the Indian economy.

The services sector has been growing faster than the physical infrastructure sector that should ideally be a necessary and important precondition for sustainable growth and development of the sectors in question.

Take, for instance, the telecommunications industry.

Telecom service providers have been growing their market and reach at a massive pace.

This is being achieved through huge investments by the telecommunication companies.

But such efforts are largely focused on acquisition of air waves or spectrum through auctions at a considerable cost and on marketing of the various attractive packages of telecommunication services, often at substantial discounts.

In contrast, little attention is paid to the need for more investment in an equally important area of telecommunication business: Building infrastructure capacity or construction of towers to carry voice or data from one subscriber to the other.

Nor is there adequate focus on the need for commensurate investment in technology-related infrastructure. Indeed, there is a tendency among telecommunication companies to outsource such infrastructure-related functions.

What should have been a core business focus area for any telecommunication company is now relegated to being outsourced from another company.

The quality and reliability of such infrastructure are increasingly going beyond the direct control of the telecommunication service providers.

This may provide short-term benefits for these companies.

But the divorce between the service and the core infrastructure, which sustains that service, has led to an odd situation, where telecommunication companies are offering seemingly attractive services, but these are neither backed by robust infrastructure nor are their availability under the control of the service providers.

The aviation sector, too, raises similar questions, but it offers a slightly different set of challenges.

Aviation service providers or the airlines and the airport operators are completely different entities and independent from each other.

But the overall efficiency and quality of aviation services are largely dependent on how robust and large is the capacity of the airport infrastructure.

In the Indian context, airport infrastructure development has sadly lagged behind the rapid growth in aviation services.

Healthy competition among a clutch of airlines has kept the fares at levels that have seen healthy growth in passenger air traffic.

The government has also fuelled this growth by launching the UDAN (Ude Desh ka Aam Naagrik) scheme, under which over 450 new routes are sought to be connected with short-haul services at fares capped at Rs 2,500 for a one-way journey.

Ironically, similar attention to building new capacity or adding to existing capacity in the airports sector is missing.

Congestion in Delhi and Mumbai airports is on the rise and other airports in Bengaluru, Hyderabad or Chennai may face a similar fate soon.

Worse, the capacity of these airports to handle rising traffic is bursting at the seams.

So, the question is: How sustainable and prudent is the policy of boosting services without commensurate growth in infrastructure in the relevant sectors?

Such a situation is certain to give rise to consumer dissatisfaction that might eventually kill the goose that lays the golden egg.

Investors may also be browned off with such sectors as they show the strains of the physical infrastructure failing to sustain the services business.

There are also obvious policy implications.

The government needs to intervene with better policy and ensure effective regulation so that these sectors can overcome these weaknesses.

The Narendra Modi government’s recent move to promote about a dozen services may fail to make any impact if it cannot quickly address these core concerns.

© 2025

© 2025