Keep exit plans handy, D-day could be the second week of August, writes Sonali Ranade in Market Notes.

I had ventured to suggest that the last correction may not be the beginning of a intermediate one and that we will have a subsequent shy at new tops. That scenario appears to be working out. Nasdaq 100 has already made a new high, SPX is pretty close to one, and others such as Nikkei, Shanghai and Nifty are not far behind. But I had also suggested that this rally may be the last before a substantial correction. I maintain that view unless the new highs are five to six per cent higher than previous tops. So keep exit plans handy. D-day could be the second week of August.

There is a rather lengthy note on the $-INR in this article. I have always argued that our whole foreign trade and foreign exchange management are riddled with flawed assumptions, not so much for lack of knowledge and understanding, but rather to protect vested interests. Cotton exports against lower cotton prices for local manufacturers is the sort of problem at one end of the spectrum. The failure to see value-addition as the key variable of domestic prosperity rather than the absolute export numbers is the other.

Take cotton. What are we exporting? Sunshine, water, labour and some fertiliser and pesticide. What do spinners add to cotton by spinning it into yarn? Barely 10 pc at enormous cost. But if you take the distribution of profits between growers and spinners, the lion's share goes to the spinners. Such is the perversity of our economy. Forex has been the key fulcrum on which the edifice to transfer wealth from farmers to industry was built under the socialist raj. The apparatus is still largely intact. Most economist know of it. Nobody talks of it.

No change in the prognosis on Nifty. Use the counter-trend rally to exit.

Happy trading.

Yield on 10-year Treasury Notes: The yield on 10-year treasury notes continued at elevated levels but moderated a bit, closing the week at 259 basis points after having made a high of 274. On the long term weekly charts, 280 basis points appears to be a good place to pause from some consolidation before the uptrend resumes. The climb in yields has been pretty steep since May. We could have a few weeks of consolidation with yields dropping back to around 200 bps as the correction sets in.

Yield on 10-year Treasury Notes: The yield on 10-year treasury notes continued at elevated levels but moderated a bit, closing the week at 259 basis points after having made a high of 274. On the long term weekly charts, 280 basis points appears to be a good place to pause from some consolidation before the uptrend resumes. The climb in yields has been pretty steep since May. We could have a few weeks of consolidation with yields dropping back to around 200 bps as the correction sets in.  Gold: Gold continues to surprise to the downside. It closed the week at $1277.60 after rallying from a new low of 1212.10. The monthly chart of gold prices here shows that while $1160 was a support area, gold is more likely to test the $950 area before it finds some solid support from long-term, long-only investors. The wave counts, the support line for the long-term uptrend support line and the fractal being traced out by gold prices, all point to further weakness in gold prices. There is plenty of time for gold prices to drift down as well. Indians would be wise to leave the metal alone for some time but then I have been warning of a bear market in gold for the past two years and more. Don't see a significant rally in gold prices until after March 2014.

Gold: Gold continues to surprise to the downside. It closed the week at $1277.60 after rallying from a new low of 1212.10. The monthly chart of gold prices here shows that while $1160 was a support area, gold is more likely to test the $950 area before it finds some solid support from long-term, long-only investors. The wave counts, the support line for the long-term uptrend support line and the fractal being traced out by gold prices, all point to further weakness in gold prices. There is plenty of time for gold prices to drift down as well. Indians would be wise to leave the metal alone for some time but then I have been warning of a bear market in gold for the past two years and more. Don't see a significant rally in gold prices until after March 2014.  Silver: Silver's first major support zone was $20, made a low of $18.17 before staging a minor rally to $20.25, closing the week at $19.792. The monthly chart here shows the next major support for silver is at $14 and it has plenty of time to get there. I don't think the metal will find any significant rallies from here until it test $14 although it can hang around current levels for a while.

Silver: Silver's first major support zone was $20, made a low of $18.17 before staging a minor rally to $20.25, closing the week at $19.792. The monthly chart here shows the next major support for silver is at $14 and it has plenty of time to get there. I don't think the metal will find any significant rallies from here until it test $14 although it can hang around current levels for a while.  HG Copper: Copper has been rather reluctant to test levels below 3.0 and has bounced back from the region on several occasions in the past. My sense is that while copper has more or less finished its price correction, it could mark time in the 2.80 to 3.40 price region before staging a significant rally. Definitely not a metal to short at these prices.

HG Copper: Copper has been rather reluctant to test levels below 3.0 and has bounced back from the region on several occasions in the past. My sense is that while copper has more or less finished its price correction, it could mark time in the 2.80 to 3.40 price region before staging a significant rally. Definitely not a metal to short at these prices.  WTI Crude: WTI crude's price has been trending up on thinner and thinner volumes for the past two years. That fact alone should make one very wary of the WTI crude chart. The second fact that puts crude's long-term chart out of kilter is the fact that it peaked in 2007, long before the rest of the commodities did so. In my view that is significant price "failure" on the long-term charts and crude's rather anomalous price behaviour points to the same fault line. There is no doubt in my mind that the technicals point to a price of WTI crude in the $80 region in the intermediate term ahead.

WTI Crude: WTI crude's price has been trending up on thinner and thinner volumes for the past two years. That fact alone should make one very wary of the WTI crude chart. The second fact that puts crude's long-term chart out of kilter is the fact that it peaked in 2007, long before the rest of the commodities did so. In my view that is significant price "failure" on the long-term charts and crude's rather anomalous price behaviour points to the same fault line. There is no doubt in my mind that the technicals point to a price of WTI crude in the $80 region in the intermediate term ahead.That said, crude has been in a counter-trend rally from a price of $84 since the June of 2012 and that bear rally could have peaked out at $107.426. My sense is that elevated crude prices reflect some sort of a technical bear squeeze that cannot persist for long. However, keep in mind crude's tendency to shoot for the highs at the slightest provocation. My sense is crude will return to test $80 levels before long. But avoid shorts.

Reuters CRB Index: The CRB Index puts the triangulation underway in commodities into global perspective. The index itself has little predictive value but it does confirm the notion that triangulation in the open auction markets is perhaps the only way to true price discovery. Note the 250 support line for the index. With the index poised at 270, we are not far from support. My sense is agricultural commodities will recover way ahead of the industrials and precious metals. But that's a subject for another day. Long-term bears will be looking to exit shorts in most commodities.

Reuters CRB Index: The CRB Index puts the triangulation underway in commodities into global perspective. The index itself has little predictive value but it does confirm the notion that triangulation in the open auction markets is perhaps the only way to true price discovery. Note the 250 support line for the index. With the index poised at 270, we are not far from support. My sense is agricultural commodities will recover way ahead of the industrials and precious metals. But that's a subject for another day. Long-term bears will be looking to exit shorts in most commodities.  US Dollar Index [DXY]: This article is all about underlying long-term trends since markets appear to be approaching an inflection point. Who looks at monthly currency charts in markets? Well, I do and it's very instructive to place things in perspective. First note that the DXY bottomed out in 2008 and then confirmed that bottom in 2011. It's been in an uptrend since then and those surprised by my bullishness on the $ for the past two years contrary to all conventional wisdom now know why. That uptrend is about to end. If it ends now, or after another six months, is the moot question.

US Dollar Index [DXY]: This article is all about underlying long-term trends since markets appear to be approaching an inflection point. Who looks at monthly currency charts in markets? Well, I do and it's very instructive to place things in perspective. First note that the DXY bottomed out in 2008 and then confirmed that bottom in 2011. It's been in an uptrend since then and those surprised by my bullishness on the $ for the past two years contrary to all conventional wisdom now know why. That uptrend is about to end. If it ends now, or after another six months, is the moot question.Note, the DXY has broken out of a fairly large and significant triangle and has since confirmed the breakout to the upside. That's the basic reason why I have been suggesting a target of 85.50 for the DXY. The index can overshoot that target to test 89 before an intermediate correction sets in. So two things stand out. First, the long bull run in the DXY is now approaching its final run-up. So things will be volatile. And second, wave Vs can be terrible in what they do to price extension. We are in wave 3 of Wave V from the bottom of 72.50 in 2011 by my count. Fasten seat-belts.

EURUSD: The EurUsd staged a smart counter-trend rally from the 1.27 price region to 1.32 before closing the week at 1.3066, sandwiched between its 200 and 50 DMAs. The rally from 1.27 upwards was reactive and the correction underway from 1.37 in February is far from over.

EURUSD: The EurUsd staged a smart counter-trend rally from the 1.27 price region to 1.32 before closing the week at 1.3066, sandwiched between its 200 and 50 DMAs. The rally from 1.27 upwards was reactive and the correction underway from 1.37 in February is far from over. My sense is EurUsd will return to test 1.27 over the next four weeks before turning up. I don't think we will see EurUsd below 1.27 in this correction.

USDJPY: UsdJpy closed the week at 99.21, a shade below its 50 DMA at 99.50. Recall UsdJpy bounced back from 94 after falling from a significant new top at 103.60. While the bounce from 94 is corrective in nature, and therefore we will see sharp corrections on the way up, my sense is that the corrective way is exhibiting sufficient strength to show higher top than 103.60; something one wouldn't expect in a cup-and-and-handle correction from 103.60.

USDJPY: UsdJpy closed the week at 99.21, a shade below its 50 DMA at 99.50. Recall UsdJpy bounced back from 94 after falling from a significant new top at 103.60. While the bounce from 94 is corrective in nature, and therefore we will see sharp corrections on the way up, my sense is that the corrective way is exhibiting sufficient strength to show higher top than 103.60; something one wouldn't expect in a cup-and-and-handle correction from 103.60.Not bearish on the dollar against the yen. And that is sort of confirmed by the technical position in both DXY and the EurUsd.

USDINR: My data vendor anbd charting service let the DXY, EurUsd, UsdJpy and UsdInr in particular fall between their two stools. One doesn't have the data and the other charts! So excuse the charts and follow the narrative carefully using whatever charts you have to track prices. For I am going to show you why I think UsdInr will be close to 70 by the end of this year.

USDINR: My data vendor anbd charting service let the DXY, EurUsd, UsdJpy and UsdInr in particular fall between their two stools. One doesn't have the data and the other charts! So excuse the charts and follow the narrative carefully using whatever charts you have to track prices. For I am going to show you why I think UsdInr will be close to 70 by the end of this year.Recall, the journey of 20 pc devaluation of the INR every decade or so began with reforms in 1990. It is the RBI's biggest folly that it devalues the INR in sudden bursts of 20 pc in a matter of weeks and then lets the INR appreciate in the interim. While that is politically convenient for the RBI and government, because the bad news can be fobbed off as a one-time crisis due to "external factors" as is being done now, it is an absolutely ruinous practice as far as exporters are concerned. Why? In the normal course exporters face an appreciating INR under the current scenario and that takes away two to three pc of their sales assuming a collection period of three to six months. While in a depreciating INR scenario, because it is usually a sudden haircut that disrupts normal markets, very few exporters can actually lock-in the benefit of a depreciating INR.

That incidentally is one of the least perverse practices of the RBI's exchange rate management. Unfortunately, the RBI treats forex management as a black art and the few bankers that actually have expertise in the area are more interested in complicating rather than simplifying things to earn fat fees and spreads. The truth is, China-style, constantly but slowly [not more than three p pa.] depreciating INR pegged to the $ would best serve India's interests. And it would eliminate all the unnecessary volatility in exchange management and reduce bankers' fat spreads across the board. But who is to tell the RBI? Our pink paper editors can't be bothered to note the difference between direct and indirect quotes in the FX markets mangling the English language daily. So bear with me as I demystify what's going on.

Back to basics. The first mega-wave of the up move of the $ began in 1990-91 when the $ went from INR 10 in 1991 to INR 49 in 2002. That was a five-part bull move of the $. I have part of the chart in my database but can't show it here. From the 49 in 2002 point began the correction to the up-move from INR 10. This is where the full folly of the RBI becomes so obvious and has proved so ruinous to our software and services industry, particularly low value added call centres, transcription services and the like. From INR 49, the RBI allowed the $ to depreciate against the rupee to INR 39 in 2007. Which is to say, over the five-year period, 2002 to 2007, every marginal player in the software and services industry was wiped out by competition from Brazil and Philippines. Export data from both countries bears out that India's loss was their gain. Remember, low-value-added services work on paper thin margins, and nothing but rents and telephony as expenses apart from labour. With little value added except labour even a three pc constant erosion of their profit margin annually wipes out their viability.

On the other hand, these businesses create a huge middle class of workers who essentially earn dollar salaries. It is their consumption that drives the demand for everything from small cars and washing machines to housing. When those jobs go abroad, their demand tanks abd so does our GDP. What's so complicated about this? The RBI should be well aware of all this. If it still allows a small number of foreign banks to structure the forex market to India's disadvantage, knowingly or unknowingly, it has only itself to blame.

And so there was the giant B wave correction from 49 to 44, the A of which did a five-part impulse wave to 39 in 2008, followed by a corrective B to 52 in 2009 and from the the terminating C down to 44 again in 2011. Was all this volatility necessary? Absolutely not. It only enriched foreign bankers and wiped out our exporters and new jobs created by them. I kid you not.

From the level of INR 44 July 2011, the dollar began the III wave up and we are in the middle of the first of its sub-waves up and the $-INR is already 60. The chart here begins to track the moves at the $-INR level 44 in July 2011. The first A wave took the dollar from 44 in July 2011 to 57.3 in June 2012. From there, the dollar has had an orderly correction down to INR 53.5 which ended January 2013. That puts the current wave up as "C" which could extend to give the full five-part impulse wave later on. For the moment we will assume just a three-part A-B-C wave up.

What do you have? As the chart shows, the 'A' part of the C wave [which itself breaks down to the usual five-part impulse wave up] took the dollar up from 53.50 to INR 61. We are now correcting for that up-move and the dollar could retest 56 from the topside in the next two to three months. As night follows day, there will be the "C" wave up from INR 56 after the correction some time towards November 2013 or January 2014. Where will "C" wave take the dollar? Connect the tops from July 2011 parallel to the rally's support line and you get a target for the dollar of 71. Safe to say the technicals point to the dollar ending 2013 at about INR 70.

Note, we have assumed a mere three-part A-B-C up from 44 in July 2011. That can extend to a five-part impulse wave whose target would be much higher. Anybody wants to bet on the $-INR just before the election results? Yep, you got that right. If C wave extends, the five-part impulse would take us to elections 2014. God help us all.

Trust me, the RBI needs some very sharp lessons in letting foreign banks run the forex markets to India's detriment. One way for it to demystify things is to realise that all that the foreign bank really does it to borrow dollars in Singapore and sell the same in Mumbai. The rate it sells them in Mumbai includes its funding cost plus commission. And a small premium because for every 100 $ sold it will get back only $85 from the market given our trade and investment deficit. The balance 15 has to come from the RBI's reserves. To postpone that 15 pc immediate outflow, the RBI virtually hands over a monopoly to foreign banks since Indian banks face a stiff funding cost in Singapore. For pennies we hand over something of huge strategic importance to firangi bankers. No wonder they make such fools of us.

So, a correction of the dollar back to 56 and then the final swing up to 71 by year-end. It is not magic, just logic of the markets.

DAX: The DAX closed the week at 8212.77 a whisker above its 50 DMA at 8173. So far the DAX is behaving as expected. Wave counts favour a retest of the recent top at 8550. In fact, we could have a higher high. But unless the higher high is at least five to six pc higher than 8550, the subsequent correction that follows in mid-August could tip the index into an intermediate correction. Look to exist. Sometimes the risk is simply not worth the potential return.

DAX: The DAX closed the week at 8212.77 a whisker above its 50 DMA at 8173. So far the DAX is behaving as expected. Wave counts favour a retest of the recent top at 8550. In fact, we could have a higher high. But unless the higher high is at least five to six pc higher than 8550, the subsequent correction that follows in mid-August could tip the index into an intermediate correction. Look to exist. Sometimes the risk is simply not worth the potential return.  Nikkei 225: The monthly chart here clearly lays out the neat arrangements made for a new high by the managers of Nikkei 225 even as it corrects from the recent top of 15962. In the initial phases of a bull move, dip buying by left-out bulls often lends a momentum to markets greater than the initial impulse. In the normal course one would expect a cup and handle correction to the rally from 8180 to 16000 which is basically wave I of a new bull super cycle for Nikkei. However, by going into a correction slightly earlier than expected and from the down-sloping bearish trend-line a trap has been laid for bears. If enough get trapped, their covering alone will ensure a new high. Note the candle to 16000 without a body but a huge spike. Price without buying, which points to the bulls' intention to return after the bears have been trapped. So avoid shorts on the Nikkei. In any case it is in a correction with little downside until the B up currently underway exhausts itself. Note the time element. A new high would sync with SPX also due for a new high mid-August. Hint, hint.

Nikkei 225: The monthly chart here clearly lays out the neat arrangements made for a new high by the managers of Nikkei 225 even as it corrects from the recent top of 15962. In the initial phases of a bull move, dip buying by left-out bulls often lends a momentum to markets greater than the initial impulse. In the normal course one would expect a cup and handle correction to the rally from 8180 to 16000 which is basically wave I of a new bull super cycle for Nikkei. However, by going into a correction slightly earlier than expected and from the down-sloping bearish trend-line a trap has been laid for bears. If enough get trapped, their covering alone will ensure a new high. Note the candle to 16000 without a body but a huge spike. Price without buying, which points to the bulls' intention to return after the bears have been trapped. So avoid shorts on the Nikkei. In any case it is in a correction with little downside until the B up currently underway exhausts itself. Note the time element. A new high would sync with SPX also due for a new high mid-August. Hint, hint.  Shanghai Composite: As mentioned earlier by me, Shanghai has completed the second leg of its correction from the top of 6060 and has now caught a counter-trend rally up that could eventually test 2450. It is not yet the beginning of a new bull move although it might look like it. China has a lot of time correction to go through although the price correction is now over. All the same it is a nice tradable rally and the downturn can easily coincide with world markets come mid-August. So don't be late to the party and get caught.

Shanghai Composite: As mentioned earlier by me, Shanghai has completed the second leg of its correction from the top of 6060 and has now caught a counter-trend rally up that could eventually test 2450. It is not yet the beginning of a new bull move although it might look like it. China has a lot of time correction to go through although the price correction is now over. All the same it is a nice tradable rally and the downturn can easily coincide with world markets come mid-August. So don't be late to the party and get caught.  Nasdaq 100: You get such long duration rallies as in the Nasdaq 100 only from an absolute nadir which is what the low of 2009 was for the index combining the low of both the correction for the bubble and the crash of 2008. In any case, the warning is clear enough. We are well into a mature rally that is ripe for correction.

Nasdaq 100: You get such long duration rallies as in the Nasdaq 100 only from an absolute nadir which is what the low of 2009 was for the index combining the low of both the correction for the bubble and the crash of 2008. In any case, the warning is clear enough. We are well into a mature rally that is ripe for correction.I wrote during the last fall that we will have another last leg up and most probably a new high. Nasdaq 100 closed the week at 3079.07 giving the promised new high. There is still two or three weeks for this rally to run. Regardless, I would be looking to exit positions. You got your new high against all odds. Take your money and run.

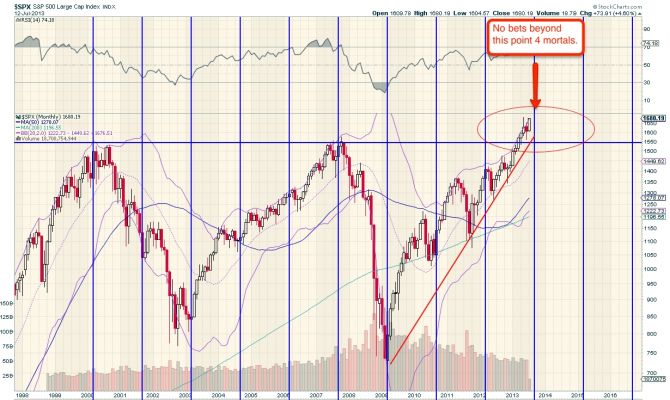

SPX: The SPX closed the week at 1680.19 just short of the previous top of 1687. With that, SPX kept its promise of wave counts that showed there would be another rally after the last fall with the possibility of a new high. I repeat what I have been saying for Nasdaq. In terms of wave counts, we have run out of telomeres. To get an extension you would need a new high five to six pc higher than the previous top such that the next correction down doesn't go lower than 1560. That's a tall order so late into a mature rally. So the prudent would take their money and run. Don't play the short game though. Not yet. Best to wait for confirmation of an intermediate down-trend.

SPX: The SPX closed the week at 1680.19 just short of the previous top of 1687. With that, SPX kept its promise of wave counts that showed there would be another rally after the last fall with the possibility of a new high. I repeat what I have been saying for Nasdaq. In terms of wave counts, we have run out of telomeres. To get an extension you would need a new high five to six pc higher than the previous top such that the next correction down doesn't go lower than 1560. That's a tall order so late into a mature rally. So the prudent would take their money and run. Don't play the short game though. Not yet. Best to wait for confirmation of an intermediate down-trend.  NSE NIFTY: By one count, but not the one I favour [both show a similar prognosis but this one is easier to explain], suggests Nifty is approaching the end of its correction from the 2008 top. Curiously, the market might hit the bottom just as the election results for 2014 come due. Coincidence? No, the trick's been accomplished by an extension to the bearish wave count. Meanwhile, the old prognosis stands. Nifty is headed up into a counter-trend rally that can see it make a new high in the region of 6300.

NSE NIFTY: By one count, but not the one I favour [both show a similar prognosis but this one is easier to explain], suggests Nifty is approaching the end of its correction from the 2008 top. Curiously, the market might hit the bottom just as the election results for 2014 come due. Coincidence? No, the trick's been accomplished by an extension to the bearish wave count. Meanwhile, the old prognosis stands. Nifty is headed up into a counter-trend rally that can see it make a new high in the region of 6300.What follows will be the terminating C for many old economy stocks like steel and financial scrips like PSU banks that will cause some mind-boggling damage to valuations. PSU banks in particular, which are some 15 to 20 pc of the market, look likely to be hit the hardest.

Look to exit and re-enter later after the carnage. Besides, it is election time. Regardless of who you favour, markets will tank well before them. Then there is the INR to contend with.

© 2025

© 2025